Estate and Asset Planning

“In this world nothing can be said to be certain, except death and taxes”. Benjamin Franklin.

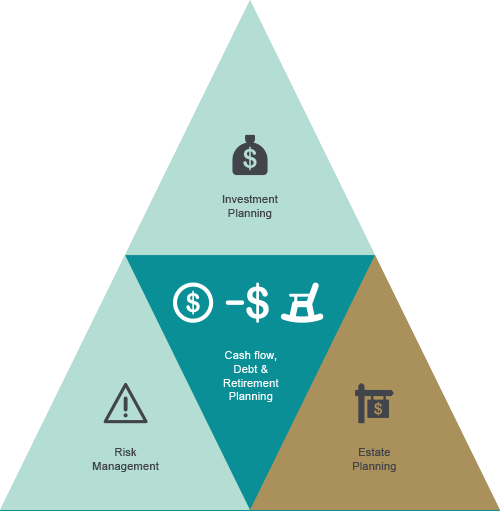

Estate planning is one of the foundations of a solid financial life. There are many tools available to ensure that you can achieve the desired outcomes you want in order to protect yourself, your family, your business and your assets.

Wills

A will ensures the distribution of your estate is carried out to your wishes upon your death. As soon as you have assets you require a will and it should be reviewed regularly to ensure it remains current. Every time you experience another lifestyle changing event, such as a marriage, new partnership or a child, you should review your will. A will not only deals with the distribution of your assets according to your wishes, it also deals with guardianship for any children you may have, your funeral choices and who you have requested to administer your estate.

Dying without a will is termed ‘dying intestate’ and your assets are distributed according to a formula set out by the law. This is unlikely to achieve the outcome you or your family would want. A will makes sure you have not left the people you care about in an awkward position.

Family Trusts

These are often called living wills and effectively you gift assets to the family trust so that they are no longer owned by you. Generally you transfer your assets to a trust and a debt is owed to you by the trust which can be forgiven without incurring tax. Your assets are owned by the trust, which is administered by trustees who must act in their fiduciary capacity for the benefit of the beneficiaries. You may still benefit from the assets held in the trust if you are a beneficiary, which is most commonly the case.

Trusts are set up for a number of reasons, such as:

- To protect your assets for your future and your family’s future

- To protect your assets against potential liability claims or unexpected business debts

- To prevent claims against your estate upon death

- To ensure your assets end up in the hands of those you intend

- To effectively structure your assets for tax purposes

The reasons for having a trust are important and although many years ago everyone seemed to have a trust, this is not necessarily the case any longer. Having the right trustees, taking legal advice and administering the trust is crucial to ensure it is seen as an appropriate and effective entity to hold assets.

Enduring Powers of Attorney

There are two types of enduring powers of attorney. One is for care and welfare and the other deals with property. An enduring power of attorney is granted to someone you trust to manage your affairs should you not be in a position to do so yourself, through either incapacity (physical or mental) or being overseas. Should you become incapacitated to such a point that you cannot manage your own affairs and you do not have an enduring power of attorney in place, the courts can appoint someone on your behalf however, it may not be someone you would have chosen, the process is costly and it takes some time to arrange.

How can we assist?

- We are experienced at reviewing wills, trusts and enduring powers of attorney and spotting gaps in your needs, especially when it comes to dovetailing in with your wider financial planning needs

- We work closely with our clients’ lawyers, accountants and trustees to ensure we work together to get the best legal agreements in place to match broader financial affairs and future goals

- We share our knowledge with you so that we can help you make the choices that are going to be in the best interests and care for you, your assets, and your family