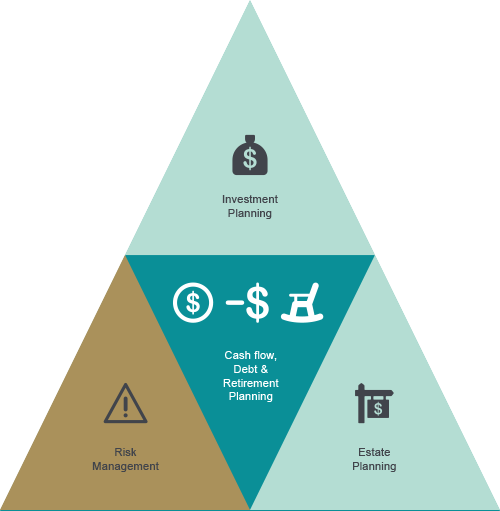

Personal Risk Mangement

“Life is inherently risky. There is only one big risk you should avoid at all costs, and that is the risk of doing nothing”. Denis Waitley

We focus on ensuring our clients have enough cover to protect them from the financial effects of an illness, death or disability but without spending so much on cover that their retirement plans are compromised. The quality of the insurance products purchased is just as important as the price paid, as essentially you are purchasing a potential future claim. Ongoing reviews are vital, cover needs to remain current and it must continue to work within your financial plan.

We would never question covering our home with fire insurance and yet people often hesitate before taking out income insurance, or decide not to bother at all. Consider the comparison of an average house value of $500,000 with an income of $60,000 pa which is lost through permanent disability from age 30-65: the income amounts to more than $2,000,0000, with no inflation adjustment. Yet, so often people do not consider covering their income.

Personal Insurance

Personal insurance is insurance which covers people and not assets or property. These are:

- Income protection insurance – this usually covers you for illness up to 75% of your gross income. You can generally obtain this cover to support your income up to 65

- Life insurance – This effectively covers the event of your death. There are several types of life cover available but most commonly used now are yearly renewable term (YRT) and level cover. YRT cover is life cover for which the premiums increase each year as your age increases. Level premium cover is life cover for which you can set the premium until a certain age, up to age 80. Whilst this may cost more than YRT in the first years it should cost you less in the long term, provided you hold it long enough

- Total and Permanent Disablement Cover – This provides for an event where you find yourself disabled and unable to work again. There are two categories of cover – ‘own occupation’ which means you must be deemed unfit to ever work in your own occupation again or ‘any occupation’ where you are deemed unfit to work in any occupation for which you are suitably skilled

- Trauma Cover – This covers around 42 medical conditions you may suffer which could interrupt your income earning ability. It pays out a lump sum and covers you for things like heart attacks, strokes and invasive cancers

- Health Insurance – This provides you with hospital cover as a base and allows you to add on cover for specialist costs, doctors, dental and cancer treatment. It ensures that should you require medical attention you are able to access private care

ACC will cover you in the event of an accident however, it will not provide you with cover for illnesses which could impact your ability to earn an income.

How can we assist?

We are not aligned to any provider or product so we are able to provide the best solutions to fit your needs. We are experienced advisers with many years of knowledge within the insurance field and can help you protect what is important to you. It is about having the right money, in the right hands at the right time.