Author Archives: Cathy

Why Use a Financial Adviser When Investing

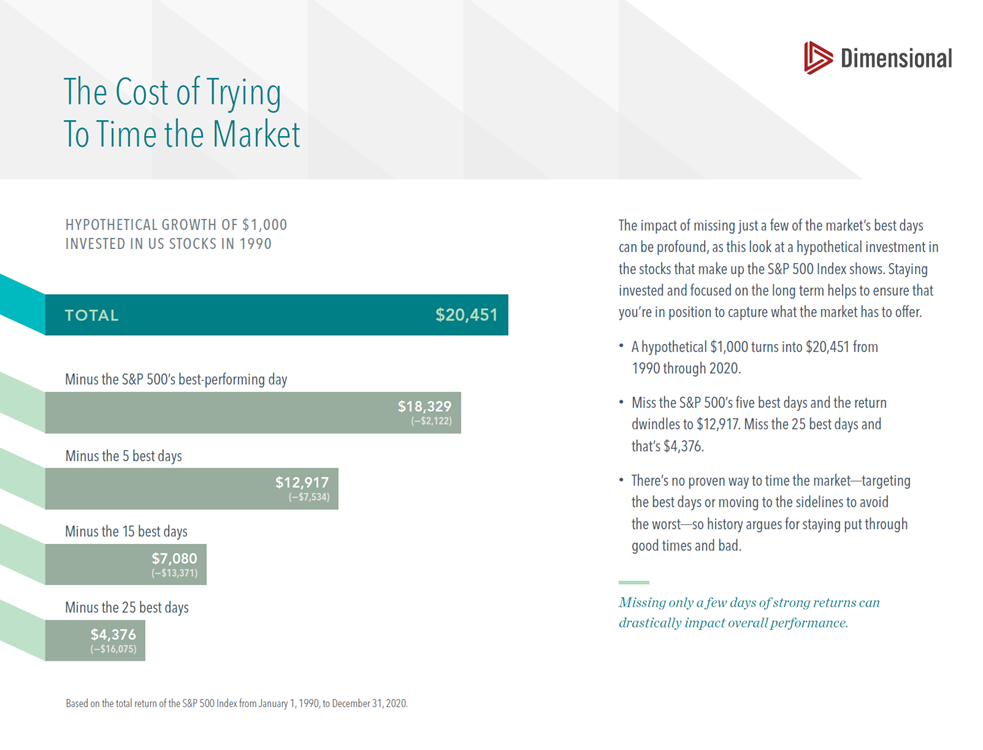

A financial advisor can provide the perspective investors need to tune out the daily noise and stay focused on a long-term plan. Check out this video about why using a financial planning professional can give you peace of mind and ensure you stay on track to achieve your goals, and not be distracted by the ups and downs of the stock markets and media hype around the economy.

Click the link below for the video

The Difference the Right Financial Advisor Makes (dimensional.com)

SHARE THIS POST

Six Simple Mind Tricks For Dealing With Uncertainty

It may feel like we are living in extremely uncertain times, and that we now lack control over many important things in our lives, but is it still possible to be happy?

Here are six tips from experts in psychology and neuroscience on how to better manage the uncertainty in your life during these unprecedented times.

https://www.bbc.com/reel/video/p08bmr62/six-simple-mind-tricks-for-dealing-with-uncertainty

SHARE THIS POST

Compound Interest: What Every Investor Needs to Know

Compound interest is one of the most important things that an investor can understand. In this video, financial journalist NORMA COHEN explains how fundamental the concept is to successful investing – as well as the potential drawbacks that investors need to be aware of.

https://www.evidenceinvestor.com/compound-interest-what-you-need-to-know/

© The Evidence-Based Investor MMXXIV

SHARE THIS POST

Why work with a REAL Financial Planning adviser? And how do you know who to choose?

Many people think they need to have a large lump sum of money to invest before seeking advice from a financial adviser, however, this is not necessarily true!!

There are many types of financial advisers – investment adviser, mortgage adviser, insurance adviser, all coming under the name of ‘Financial Adviser’, so be sure you understand what their expertise is, before you engage their services – they need to fit with what you want and need.

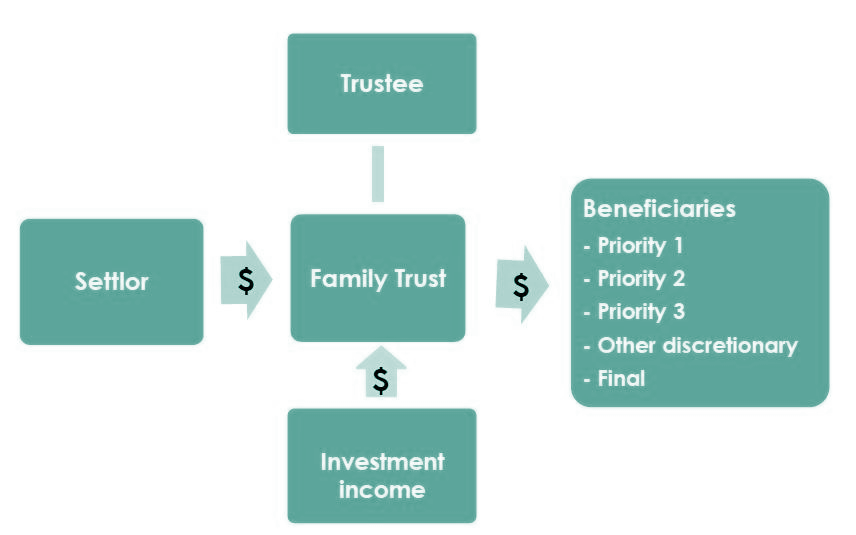

When it comes to PLANNING however, where you want someone who has experience in a whole range of financial matters that we come across in our lives, such as paying off debt alongisde investing too, saving for your children’s future and your own retirement, where to invest your money (property, shares or both), how to ensure you have the right ownership structures in place (individually, jointly, in a Trust or your business), safeguarding your wealth and income with the best personal insurance and ACC solutions, and protecting your hard earn assets through Wills, Enduring Powers of Attorney and Trusts, you need the expertise of a FINANCIAL PLANNER.

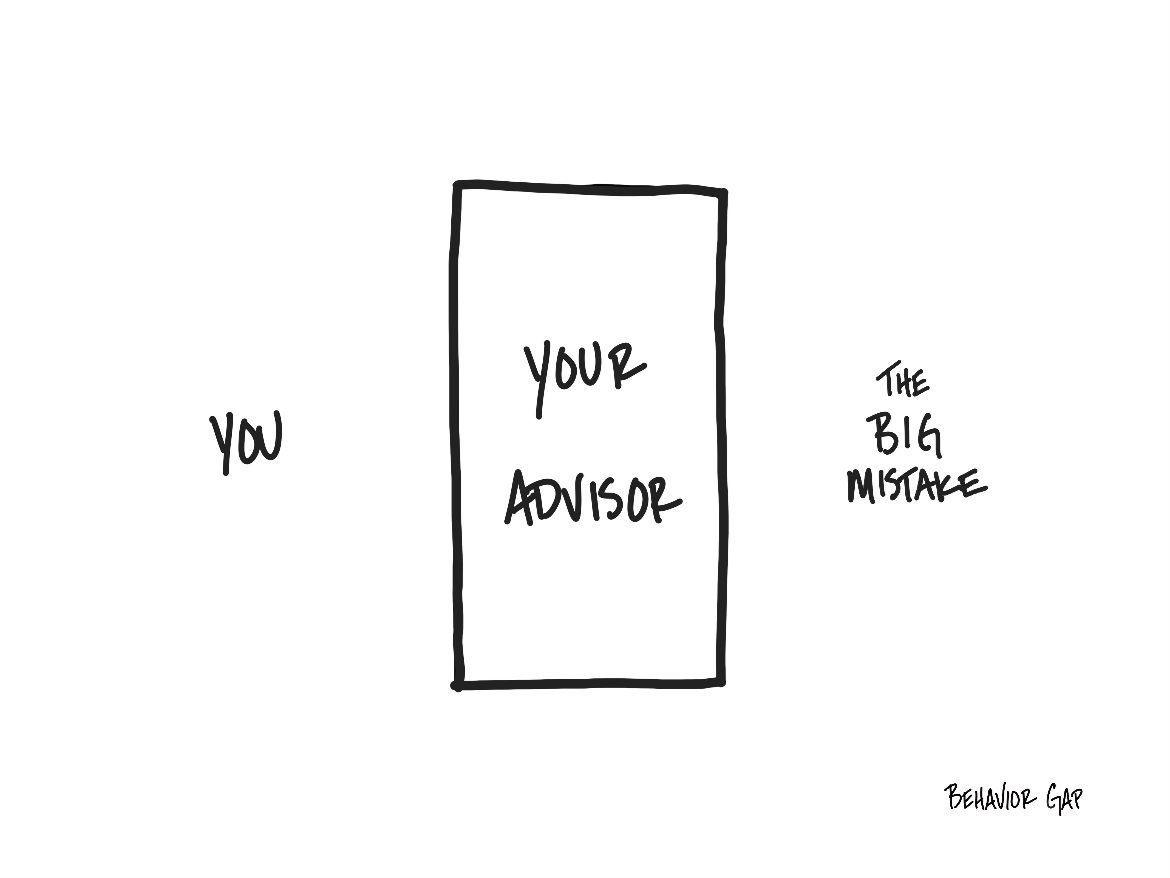

A FINANCIAL PLANNER, especially a Certified Financial Planner CFPcm , is an expert who has the skills, qualifications and experience to cross all these arenas and provide you with holistic advice and ongoing guidance, giving you peace of mind, security, and someone you can use as sounding board when times are tough. They want to know who you really are and what’s important to you, so they can help you make informed decisions on how to ‘get ahead’ and save you from making any big mistakes that may ‘set you back’ financially.

Look for a Certified Financial Planner CFPcm who enjoys working across all areas of your financial life and wants to build a long term relationship with you, loves sharing knowledge and ideas yet will challenge you when needed, and will keep you on track to living your best life!

Jane Benton & Charlene Overell

G3 Financial Freedom Ltd

Certified Financial Planners CFPcm / Acredited Investment Fidudiaries AIF®

SHARE THIS POST

Let’s Talk Legacy: Engaging the Family in Financial Planning for the Next Generation

We hope this message finds you well and in good spirits as we approach the holiday season. As we gather together to celebrate our shared traditions, we wanted to propose a meaningful conversation that goes beyond the usual festive cheer.

We believe it’s time for us all to come together and discuss something equally important—our family’s financial future. It’s a topic that may not have been in the forefront of our conversations, but addressing it collectively could make a significant impact on the generations to come.

Here are a few thoughts on how we can all engage in meaningful financial planning discussions:

- Family Financial Gathering: Consider organising a family financial gathering during the holidays or another convenient time. This could be an informal get-together where everyone can share their individual financial goals, challenges, and dreams. Creating an open space for conversation can be enlightening and foster a sense of shared responsibility.

- Educational Sessions: To ensure that everyone is on the same page, why not arrange for educational sessions on financial planning. These sessions could cover topics like budgeting, investing, saving for education, and retirement planning. Bringing in a financial planning professional to guide everyone through these discussions could provide valuable insights tailored to your family’s unique needs.

- Setting Family Financial Goals: Collectively set financial goals for your family. Whether it’s saving for a significant event, creating an emergency fund, or planning for future generations, having clear objectives will guide your financial decisions and create a sense of purpose.

- Teaching Financial Literacy: Consider incorporating financial literacy into your family traditions. For instance, this could involve the younger members in budgeting discussions or sharing stories about financial successes and lessons learned. By instilling financial literacy early on, we empower the next generation to make informed decisions.

- Legacy Planning: Discussing your family legacy can be a powerful motivator for financial planning. Whether it’s passing down financial values, creating a family foundation, or ensuring a smooth transition of assets, planning for our financial legacy can bring a sense of continuity and purpose.

- Celebrate Milestones: Acknowledge and celebrate financial milestones within the family. Whether it’s paying off a significant debt, achieving a savings goal, or making a wise investment, recognising and celebrating these achievements fosters a positive financial culture within the family.

- Encourage Questions and Involvement: Create an environment where everyone feels comfortable asking questions and actively participating in financial discussions. By fostering an open dialogue, we can collectively learn from each other and make informed decisions.

We believe that by engaging in these conversations, we can lay the foundation for a financially secure and thriving family. Let’s embark on this journey together and make financial planning an integral part of our family legacy.

Please feel free to reach out to us if you’d like assistance with you and your family considering any of these ideas.

Charlene Overell

G3 Financial Freedom Ltd

SHARE THIS POST

“Cooking Up Success: Crafting Your Financial Recipe for a Prosperous Future”

Just as a chef meticulously selects ingredients to create a masterpiece in the kitchen, achieving financial success requires careful planning and a strategic recipe. In the realm of personal finance, consider yourself the chef, and your financial goals the delectable outcome. In this article, we will explore the key ingredients and steps to concocting your financial recipe for a prosperous future.

- Define Your Financial Goals: Just as a chef starts with a vision of the dish they want to create, begin your financial journey by clearly defining your goals. Whether it’s purchasing a home, retiring comfortably, or starting a business, having a clear picture of your objectives is the first step in crafting your financial recipe.

- Create a Budget – The Foundation of Your Recipe: A budget is the financial foundation upon which success is built. Similar to measuring ingredients in a recipe, create a detailed budget that outlines your income, expenses, and savings goals. Knowing where your money is going allows you to make intentional decisions about how to allocate resources.

- Save and Invest – The Building Blocks of Wealth: Just as a chef carefully selects premium ingredients, be intentional about saving and investing. Set aside a portion of your income for savings and explore investment opportunities that align with your goals. Investments act as the building blocks of wealth, providing returns that can grow over time.

- Diversify Your Portfolio – Mix it Up: In the world of finance, diversification is akin to mixing different flavours to create a balanced dish. Diversify your investments across various asset classes to spread risk and enhance potential returns. A well-mixed portfolio can weather economic fluctuations and provide stability.

- Debt Management – Balancing Flavors: Just as a chef balances flavours in a dish, managing debt is about finding the right equilibrium. Prioritize high-interest debts and work towards paying them off. Consider consolidating or refinancing to achieve a more favourable balance in your financial flavours.

- Continuous Learning – The Seasoning of Success: Successful chefs are always learning and experimenting with new techniques. Similarly, financial success requires continuous learning. Stay informed about market trends, financial tools, and opportunities. This ongoing education adds seasoning to your financial recipe, enhancing its flavour over time.

- Emergency Fund – The Safety Net: Every chef has a contingency plan in case something goes wrong. Similarly, build an emergency fund as your financial safety net. Having three to six months’ worth of living expenses set aside provides peace of mind and ensures you can weather unexpected financial storms.

- Insurance – Protecting Your Recipe: Just as chefs use lids and covers to protect their creations, insurance safeguards your financial recipe. Ensure you have adequate health, life, and property insurance to protect against unforeseen events that could potentially disrupt your financial stability.

- Review and Adjust – Taste Testing Your Recipe: Successful chefs taste their creations throughout the cooking process. Similarly, regularly review your financial recipe. Assess your progress towards goals, adjust your budget as needed, and reallocate resources based on changing circumstances. This active involvement ensures your financial recipe stays on track.

- Seek Professional Advice – Consulting the Master Chef: Just as aspiring chefs seek guidance from master chefs, consider consulting with a financial planning adviser. A seasoned professional can provide insights, strategies, and guidance tailored to your unique financial palate, especially when you may only have time to create small parts of the financial dish yourself, needing an expert who can add their creative knowledge to better the end result.

Conclusion:

Creating a financial recipe for success is an art that requires patience, dedication, and careful planning. By defining your goals, budgeting, saving, and investing wisely, you can craft a recipe that leads to a prosperous and fulfilling financial future. Much like a well-prepared dish, your financial success will be the result of thoughtful preparation, attention to detail, and a dash of creativity. Bon appétit!

Charlene Overell

G3 Financial Freedom Ltd

SHARE THIS POST

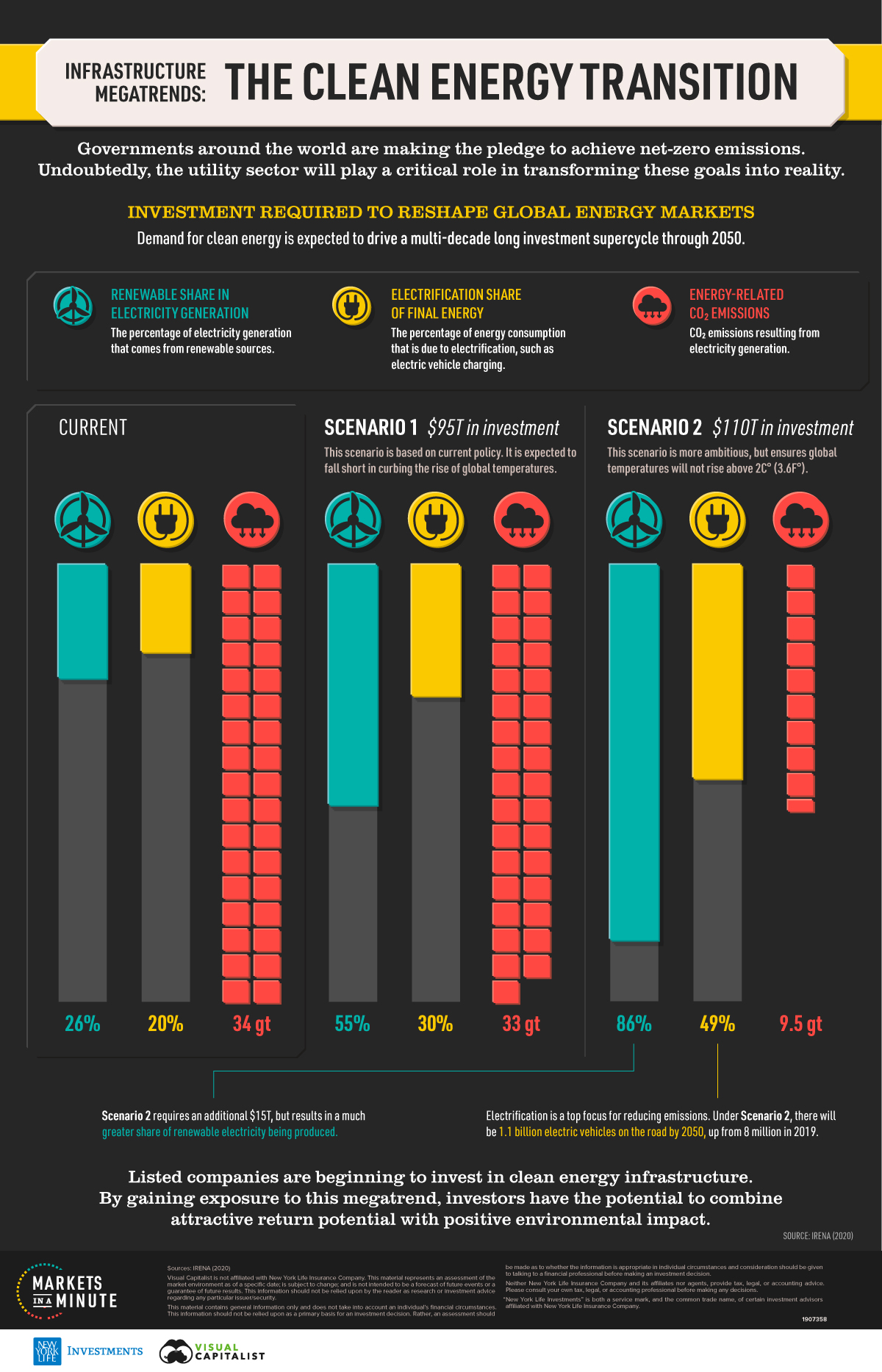

Investing During Inflationary Times – Does A Term Deposit Really ‘Cut It’

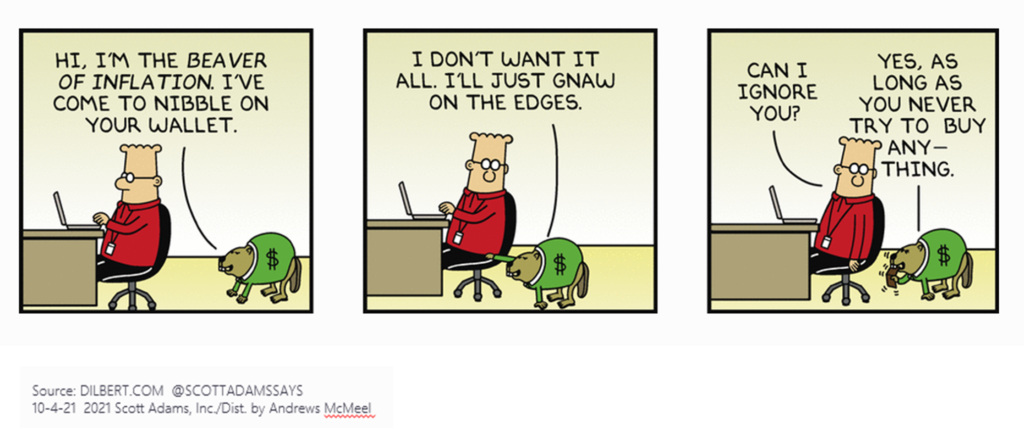

So, what is inflation? Investopedia describes it as “a rise in prices, which can be translated as the decline of purchasing power over time”.

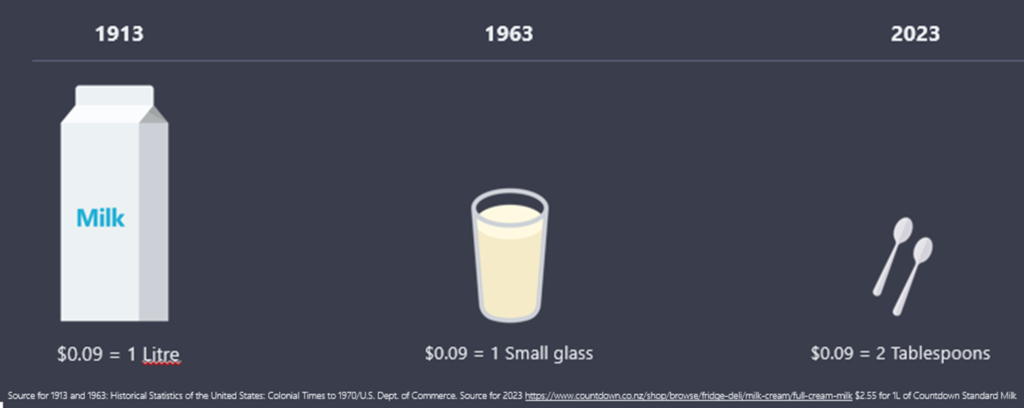

Let’s have a look at the price of a cup of black filter coffee over time:

And the price of milk back in 1913 was $0.09 for 1 litre, which in 1963 would have bought you 1 small glass and today in 2023, would buy you 2 tablespoons!!

The inflation tax, by Warren Buffet:

“It makes no difference to a widow with savings in a 5% (term deposit) whether she pays 100% income tax on her interest income during a period of zero inflation or pays no income tax during years of 5% inflation. Either way, she is ‘taxed’ in a manner that leaves her no real income whatsoever. Any money she spends comes right out of capital. She would find outrageous a 100% income tax but doesn’t seem to notice that 5% inflation is the economic equivalent”.

Inflation erodes cash’s value

It appears that now, whilst bank savings interest rates are higher than they were a few years ago, there is a view by some people, that leaving money in cash in the bank, maybe within a term deposit account, is the best option to help grow their money, or at least leave it there whilst they feel the share markets or the economy will get better. Unfortunately this is a misconception. Whilst cash is good for short term savings for specific items, maybe a holiday, car, wedding or home deposit, and especially for emergency purposes, cash is not ideal for growing wealth for the long term. One of the most significant drawbacks of investing in cash is that it fails to keep pace with inflation

If we can receive a term deposit rate of say 6% pa (gross, so before tax), and inflation is running at 7%, then we have already lost 1% of its value in a year, meaning what we can buy today for our money, we will not be able to buy next year. If we are paying tax at the 30% rate too for example, then the rate after tax (net) is 4.2%. Turning this into dollars, if we invest $100,000 in that same term deposit account, then after 30% tax the interest earned at the year end is $4,200. However, whilst we still have the $100,000 in our account, as inflation was 7%, and we only earned 4.2% after tax, then this capital value has gone backwards in real terms to $97,200……..meaning that what we could have bought for $100,000 the previous year, is going to cost us $102,800 this year.

If we continue to invest in cash with the illusion that our capital will remain intact, then whilst on paper it will, in real terms it will not. Just compound the above example over many years and we can see how the value is being eroded year on year by inflation.

Diversification reduces risk

Thinking about what we want from our money in life, now, and over the medium and longer term, is the key, and then having our money allocated to different ‘buckets’ will support our spending needs throughout the rest of our life.

So yes, whilst cash is good for the short term savings we need for specific items and for a ‘rainy day’, having a well-diversified portfolio of shares and bonds will help to keep pace with inflation, grow wealth, and ensure there will be enough to pay the bills and enjoy the life we want over the next 10+ years.

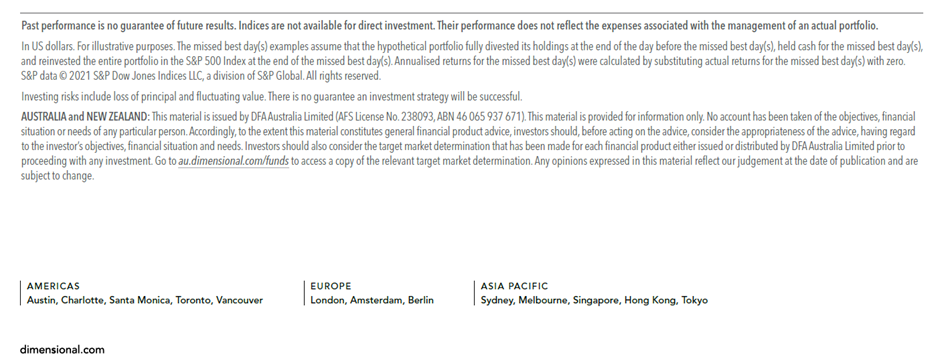

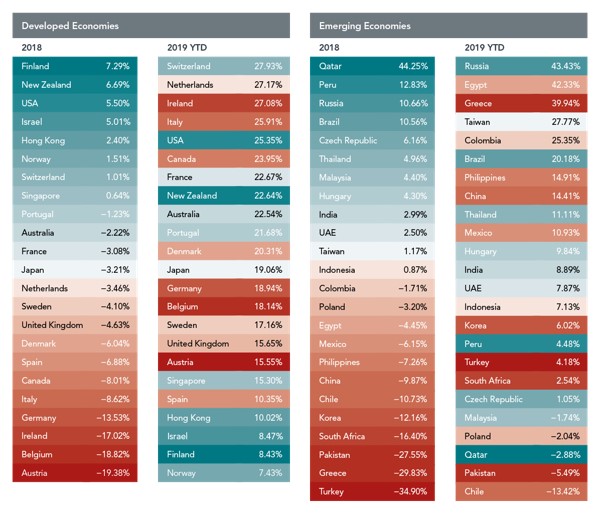

Historically, the average annual return on the stock market, adjusted for inflation, has been significantly higher than the return on cash investments. Shares have the potential to provide us with the capital appreciation needed to grow wealth and maintain its value in the face of rising prices.

Investing solely in cash exposes our wealth to significant risks, such as economic downturns, changes in interest rates, and unexpected expenses that erode the value of our cash. Building a well-diversified portfolio, which typically includes shares and bonds from various industries, sectors and across the world, will reduce this risk. Diversifying worldwide also helps protect our investments from the impact of a single company’s poor performance or a specific economic downturn. Even during market fluctuations, the broader market tends to recover over time, reducing the risk of losing our entire investment.

Property vs shares

Property, like shares, is a growth asset and has historically shown to outperform cash over the longer-term too. However, whilst investing in property provides a rental income for those wanting income, or a potential capital growth in the future, we need to be careful that this income return is actually a good one for the risk we take, after taking account of all expenses for running the property and tax we have to pay. A capital gain can be achieved, however, we need to be mindful of what this gain may be after taking account of all costs during the term of holding it.

The downside of property is that if we need money for a specific spend, then we cannot ‘carve’ a lump sum of cash off of the side of our property, meaning it is illiquid. We would have to wait to sell it to release the cash value, or be forced to sell it (which may be not ideal depending upon property values). Holding a well-diversified quality share portfolio means we can release money when we need it, as this is liquid and shares/bonds can be sold pretty much straight away. Having a combination of both property and shares may be ideal depending upon your goals.

Conclusion

Whilst cash has its place in a well-rounded financial strategy, relying on it solely as an investment vehicle can hinder your long -term financial goals. The erosion of purchasing power due to inflation, limited returns, and the absence of compounding, makes cash less than ideal for wealth creation.

If you come into wealth suddenly, through the sale a property, a business, or an inheritance, then of course put this into cash in the bank temporarily – this will give you time to breath and to seek independent financial planning advice from an expert adviser who can carefully consider your risk tolerance and tailor a plan to suit your goals and tax position. Although shares come with their own set of risks, a well-managed portfolio can help you build wealth and achieve your financial objectives over time.

Charlene Overell 16.09.23

SHARE THIS POST

UK Supreme Court Delivers Milestone Judgement On A Bank’s Duty To Follow Customer Instructions

The United Kingdom’s Supreme Court has delivered an important judgement holding that where a customer has unequivocally authorised and instructed its bank to make a payment, the bank must do so and is not under any obligation to make further enquiries. This article from Bell Gully shares how they expect this judgment to be influential on New Zealand courts.

Sophie East and Jack Worthington

The United Kingdom’s Supreme Court has delivered an important judgment holding that where a customer has unequivocally authorised and instructed its bank to make a payment, the bank must do so and is not under any obligation to make further inquiries1.

This provides a refinement of what was previously referred to as the ‘Quincecare’ duty. In making this finding, the Supreme Court provides a helpful analysis of the agency relationship between a bank and a customer, and makes special mention of the scholarship of New Zealand academic, Professor Peter Watts. We expect the judgment to be influential on New Zealand courts.

Facts

The case concerned a couple, Dr and Mrs Philipp, who fell victim to a type of fraud known as “authorised push-payment” (APP) fraud. This is when an individual authorises their bank to send a payment of monies to a bank account that is controlled by a fraudster. In this case, Dr and Mrs Philipp were contacted by an individual claiming to working for the Financial Conduct Authority in conjunction with the National Crime Agency. Through a series of communications, Dr and Mrs Philipp were led to believe that they needed to move their money to a “safe account” to protect their funds. Acting on the advice of the fraudster, the Philipps went to a branch of Barclays Bank where they gave instructions for an international payment to be made from their bank account to an account in the United Arab Emirates. As a result of the fraud, a total of GBP700,000 in two payments were made to the fraudster’s bank account, and was unable to be recovered by the bank.

Mrs Philipp brought proceedings against Barclays for what she claimed was a breach of the duty of care that the bank owed her as a customer. In reliance on what is known as the Quincecare duty of care, Mrs Philipp argued that the bank was under an implied common law duty to refrain from executing her instructions as it had reasonable grounds for believing that the order was an attempt to misappropriate her funds. In reply, Barclays applied for summary judgment that the claim be dismissed on the basis that the bank did not owe Mrs Philipp such a duty.

The High Court agreed with the bank, and summary judgment was awarded in favour of Barclays. This decision was then successfully appealed by Mrs Philipp to the Court of Appeal. The Court of Appeal found that the bank does owe a contractual duty to its customers, as outlined in Quincecare, and whether such a duty exists on the facts in this case was to be decided at trial. In turn, Barclays appealed this decision to the Supreme Court.

What is the Quincecare duty?

The Quincecare duty, from the judgment of Steyn J in Barclays Bank plc v Quincecare Ltd2, requires a bank to make inquiries about the validity of a customer’s instruction if it has reasonable grounds for believing that the instruction is induced by fraud and would result in the misappropriation of the customer’s funds. This duty, which has been cited positively by New Zealand courts3, had previously only applied to cases where agents were engaging with the bank purportedly on the instructions of a customer. However, the English Court of Appeal in the Philipp case found that the duty also extended to circumstances where the bank has received instructions from the customer directly. That was the issue on appeal to the UK Supreme Court.

UK Supreme Court judgment

The Supreme Court rejected the argument that the Quincecare duty should extend to cases where a customer has given direct instructions to the bank to make a payment. On behalf of the Court, Lord Leggatt highlighted the basic and strict duty of a bank under its contract with a customer to make payments from the customer’s account in compliance with the customer’s instructions. In other words, “it is not for the bank to concern itself with the wisdom or risks of its customer’s payment decisions.”4 In emphasising the strict nature of this duty conferred on banks, the Court cited Westpac New Zealand Ltd v MAP & Associated Ltd where the New Zealand Supreme Court found that even when a bank has reasonable concerns that it might incur legal liability by carrying out a customer’s payment instructions, this is not enough to afford the bank a defence to a refusal to carry out instructions (rather, the bank must show it would have actually incurred liability)5. For Dr and Mrs Philipp, because they gave direct instructions to the bank to make the two payments totalling GBP700,000, there is no question as to the validity of the instruction that was given to Barclays. Any refusal by the bank to carry out this instruction would be a breach of duty by the bank.

Thus, the UK Supreme Court in Philipp confined the Quincecare duty on banks to make inquiries to a specific type of situation (where instructions are made via an agent and give grounds for suspicion), but held this does not apply to direct instructions from a client itself (which the bank is obligated to carry out).

What is particularly interesting about the Supreme Court judgment is its discussion of the role of the court versus the legislature. The Supreme Court acknowledges that the type of fraud that Dr and Mrs Philipp fell victim to is a growing social problem. However, it states that “whether victims of such frauds should be left to bear the loss themselves or whether losses should be redistributed by requiring banks which have made or received the payments on behalf of customers to reimburse victims of such crimes is a question of social policy for regulators, government and ultimately for Parliament to consider.”6

Comment

In New Zealand, our Supreme Court has already held in Westpac v MAP that banks are under a strict duty to comply with legitimate payment directions made by their customers. Absent a provision in the bank’s terms that permits some other approach, banks generally do not have a discretion as to whether or not to make a payment. This gives customers confidence that their directions will be followed, and allocates responsibility firmly with the customer that gives the instruction. The Philipp case is likely to be a further barrier to claims in New Zealand against banks by customers (or others) seeking to recover losses arising from the execution of legitimate payment directions.

If you have any questions about the matters raised in this article, please get in touch with the contacts listed at the start of this article or your usual Bell Gully adviser.

[1] Philipp v Barclays Bank UK PLC [2023] UKSC 25.[2] Barclays Bank plc v Quincecare Ltd [1992] 4 All ER 36.[3] See, e.g., Tandem Group Limited v ASB Bank Limited [2021] NZHC 51 at [31] to [37].[4] Philipp at [3].[5] Westpac New Zealand Ltd v MAP & Associated Ltd [2011] NZSC 89, [2011] 3 NZLR 751.[6] Philipp at [6].

SHARE THIS POST

There’s No Time Like The Present – The Importance Of Wills And Enduring Powers Of Attorney

Wills and Enduring Power of Attorney documents are among the most important legal documents, but are often overlooked. Everyone from as young as eighteen should have these documents for the reasons set out below.

Wills

Why is a Will important

A Will sets out a person’s wishes after they die and appoints a person or persons called executors to be legally responsible for carrying out these wishes. It often comes as a surprise to New Zealanders that if you do not leave a Will recording how you would like your assets to be distributed, then the Administration Act 1969 (“the Act”) will decide for you.

What happens if you die without a Will

Someone (generally a family member) then must apply for Letters of Administration if the estate is valued over $15,000 and ask to be the administrator of the estate. This process can be more costly in comparison to that involved when the deceased has left a valid Will.

The application is made to the High Court and can take some time to be processed. The administrator then has full authority to distribute the assets in accordance with the Act which dictates who is to receive the deceased’s personal chattels and balance of assets. The Act’s order of priority may not align with your wishes. By way of example, in the case of a surviving spouse and children:

- the spouse receives:

- All of the deceased’s personal belongings.

- A set dollar amount which is currently $155,000, plus one-third of the rest of the deceased’s estate (i.e. home, KiwiSaver, personal bank account balances).

- The children receive the other two-thirds of the deceased’s estate in equal shares.

Matters to consider

If you do not have a Will or have not updated your Will for some time, you should consider the following:

- Who would I trust to be responsible for my assets when I pass?

- Who do I want to ensure is looked after when I pass?

- Do I have any special items that I want to give to particular people?

- Do I want to set up a Trust when I pass or gift money or property to an existing Trust?

- Do I want to support a charity or community organisation?

- What is to happen with my Māori Land interests?

- Who will look after my infant children when I pass?

- What funeral arrangements would I prefer?

Enduring Power of Attorney

What is an Enduring Power of Attorney

Enduring Power of Attorney (“EPA”) documents are equally as important as Wills. They protect you and your family in the event that you lose mental capacity (which could be as a result of an accident or medical condition). These documents authorise particular persons to step in and manage your affairs during your lifetime.

There are two types of EPA:

- EPA in respect to property – Management of your personal finances and property.

- EPA in respect to personal care & welfare – Decisions round wellbeing including where you live and how you will be cared for.

You require two documents (one for each type of EPA) in order to cover all circumstances.

What happens if you lose mental capacity without having EPA documents in place

In the absence of EPAs, your loved ones would be faced with having to apply to the Family Court for the appointment of a property manager and welfare guardian. This can be a lengthy and costly process for loved ones who are already in a stressful situation.

Matters to consider

- Who do I trust to make decisions in respect to my wellbeing?

- Who do I trust to manage my personal finances and assets?

- Who do I wish to appoint as a back-up attorney?

- Do I want my attorney to consult another person or persons?

- Do I want my attorney to provide another person or persons with information?

- Do I want to impose any conditions?

Next Steps

Holland Beckett Law can assist with all of your estate planning needs. There is no time like the present, so please reach out to get your estate planning underway.

Brittany Ivil

Associate

07 928 7098

Brittany.Ivil@hobec.co.nz

SHARE THIS POST

What Does The New Trustee Tax Rate Mean For You?

As part of the Budget earlier this year, the Government surprised us with an announcement that it would raise the tax rate on Trusts from 33% to 39%, effective from 1 April 2024. For a Budget which was badged as having ‘no major tax changes’, this felt like a major change for the 400,000 Trusts registered in New Zealand.

This change brings the trustee tax rate into alignment with the highest personal income tax rate; and in line with Australia, Canada, the United Kingdom, and the United States who all align their trustee tax rates with top personal tax rates.

The rationale was a spike in the amount of income being put through Trusts, rising by $5.7b, or almost 50% from $11.4 in the 2020 tax year to $17.1b in 2021. The Government expects to raise a further $350m in tax per year following this change.

Will this change impact all Trusts?

Many Trusts will be used solely to own a family home and possibly a bach, so will be inactive for tax purposes and not affected at all.

The target for this increased Trust tax rate is wealthy individuals who invest, earn and retain wealth within Trusts which currently pay a flat 33% tax on income generated.

In the middle are many family Trusts that generate income from money invested in bank deposits, fixed interest, shares, and property investments. For those trusts that distribute the income to beneficiaries on lower tax rates, there will be no change. However, those that reinvest earnings within the Trust are likely to suffer collateral damage and will end up paying the higher tax rate.

Each year, accountants review income generated by Trusts and beneficiaries to determine how best to treat the income – either a) allocate it to beneficiaries and pay tax at their personal rates, or b) retain it within the Trust and pay tax at the trustees tax rate.

In making this decision, accountants and trustees consider various factors including:

- actual distributions made during the last year

- payments expected in the year ahead

- tax credits available

- expenses or losses to be claimed, as well as

- the best treatment for tax purposes

To illustrate, here is a simplified example:

ABC Trust has an investment portfolio and two main beneficiaries, Mr and Mrs Smith. Gross taxable income generated during the year was as follows:

- ABC Trust $ 15,000.00

- Mr Smith $ 30,000.00

- Mrs Smith $ 55,000.00

At the end of the tax year, the trustees can choose how to allocate that income. Each option results in different levels of tax payable on that income, as illustrated below:

- Retain the income with the Trust = $15,000.00 x 33% = $5,000.00 tax

(This would rise to $5,850.00 under the new 39% trustee tax rate)

- Distribute the income to Mr Smith = $15,000.00 x 17.5% = $2,625.00 tax

- Distribute the income to Mrs Smith = $15,000.00 x 30% = $4,500.00 tax

In the above example, the most tax effective option would be to allocate and distribute income to Mr Smith as he has the lowest taxable income and marginal tax rate (17.5%).

Are there any exceptions?

While many Trusts will be impacted by the above rules, there are some situations where income may not be taxed at 39% despite being retained in the Trust. For example:

- Deceased estates and disabled beneficiary Trusts will be exempt from this new top tax rate

- Trusts which have tax losses or deductible expenses that can be offset against income

- Income earned within a PIE (or Portfolio Investment Entity) which has elected a 28% PIE tax rate, making such investments more attractive for Trusts

- Company earnings for shares owned by Trusts, where income is retained in the company and not paid out as a dividend

- Charitable Trusts, which do not pay tax on income generated

Is there still value in having a Trust?

The answer to this question is … it depends. Determining the value of having a Trust should always come back to it’s purpose and what benefit it provides to beneficiaries, both the original settlors and future generations; now and in the future. In our view, there are still valid asset protection reasons for Trusts, including:

- Succession and estate planning

- Providing financial support for specific people

- Creditor protection for self-employed or business owners

- Family asset protection

- Separating assets from matrimonial and relationship property

- Protection from any future estate or death duties

What should you do?

With the higher tax rate and increased scrutiny of Trust activity, trustees need to balance the administration costs and tax obligations with the overall purpose of the Trust and the benefits it provides for beneficiaries. Trusts are not for everyone, however, there are clear benefits available in the right circumstances. The increased trust tax rate is just another factor for trustees to consider when determining the appropriateness of the Trust.

The G3 team has extensive experience in working with Trusts and considering the tax implications of investing as a part of broader financial planning advice. Please get in touch if you would like to discuss your situation.

Disclaimer: The above information is of a general nature only. The information in this article does in no way constitute legal or taxation advice and all readers should contact a professional for advice relating to their specific circumstances.

SHARE THIS POST

Scam Watch

It seems there are more sophisticated investment scams that regulators both here and in Australia are aware of. Australians lost $3.1 billion in scams last year, an 80% increase on the 2021 total (Targeting Scams Report, Australian Competition and Consumer Commission, 17 April 2023). Here in New Zealand, regulators estimate one in five Kiwis have now been targeted by scammers (Real Life Scam Stories, Financial Markets Authority, 31 May 2023).

Check out these two links from the New Zealand Financial Markets Authority (FMA) to ensure you protect yourself and are aware of how scammers are targeting consumers Scam Basics and FMA warning of interest rate comparison site scam

Scam basics | Financial Markets Authority (fma.govt.nz)

Also check out, You’ve Been Scammed By Nigel Latta, a four-part televison series that looks at how criminals prey on human weaknesses – love, greed, fear and trust – to scam us out of our hard-earned cash. This begins on TVNZ 1 on Monday 3rd of July at 8pm.

SHARE THIS POST

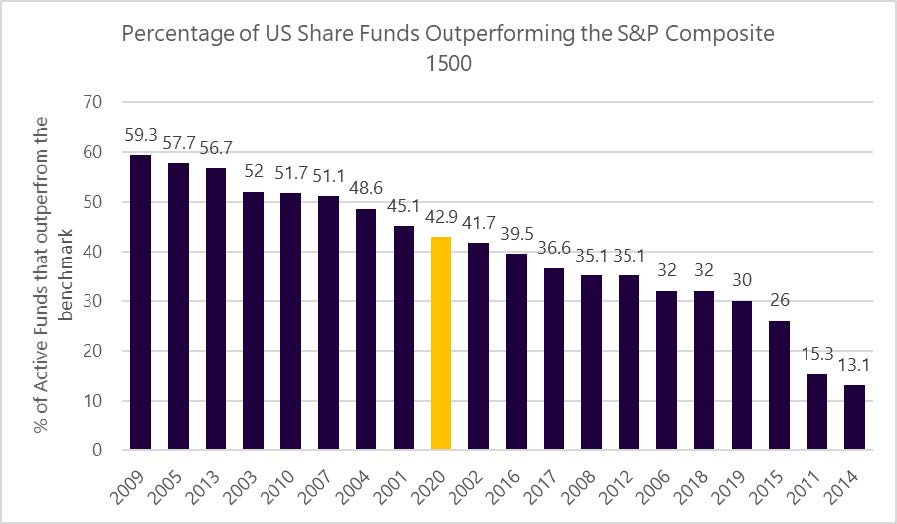

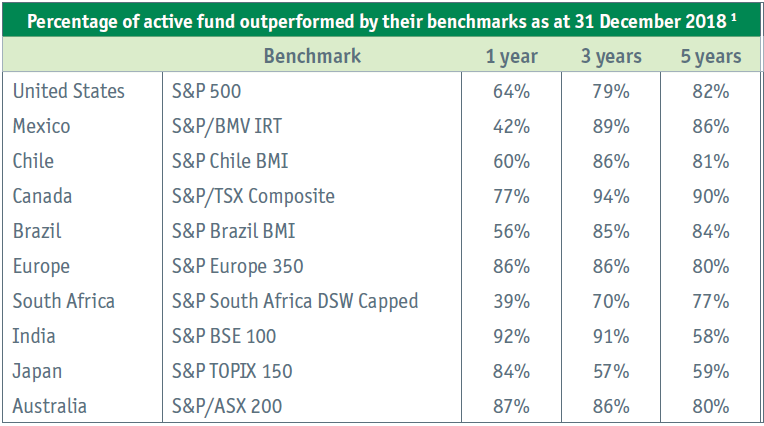

What Is The Success Rate Of Actively Managed Funds?

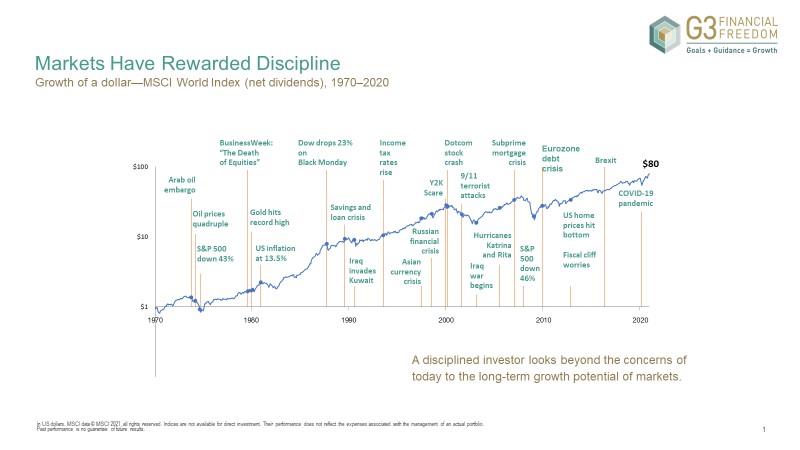

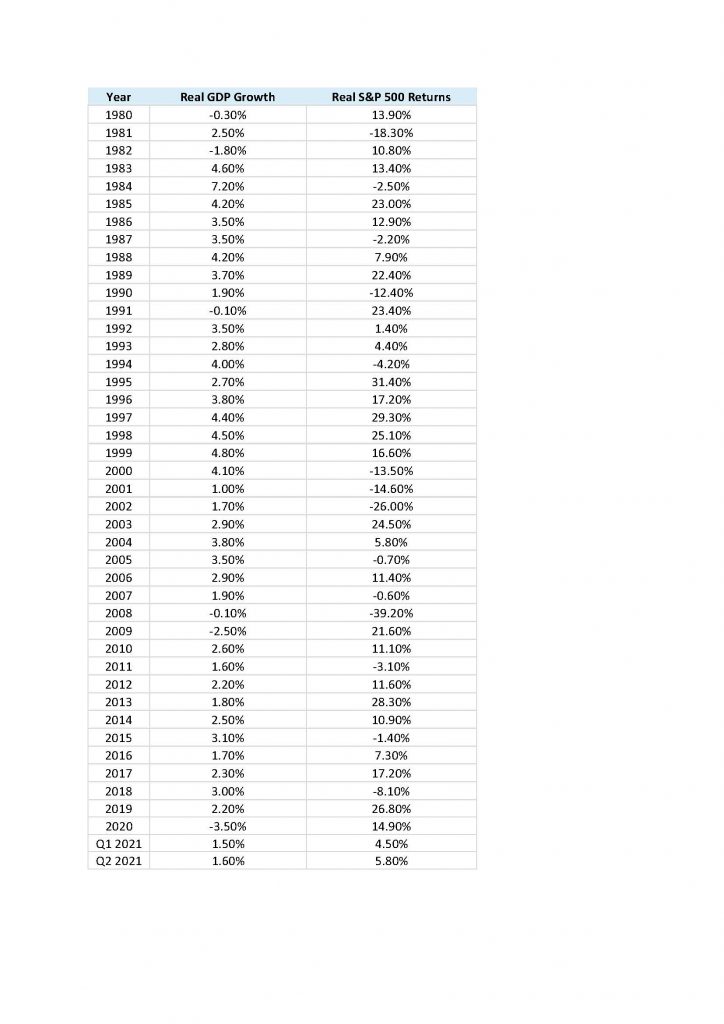

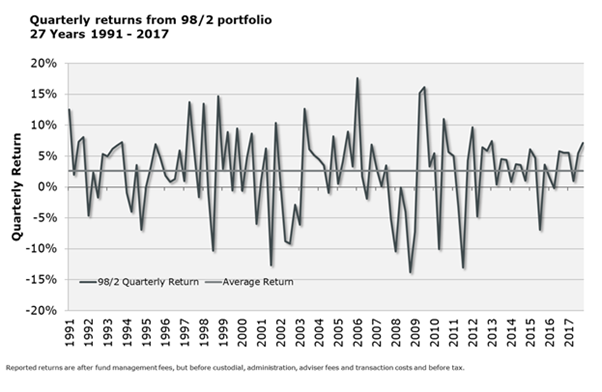

As our clients know, we prefer to refer to evidence around how best to invest money, and there are many studies showing that this ‘evidenced based’ approach proves the best solution over the longer term, and trying to predict where to invest for the future is futile. This article is proof that this approach is still the best solution, and is why we do not subscribe to investing in funds that are classified as ‘active’

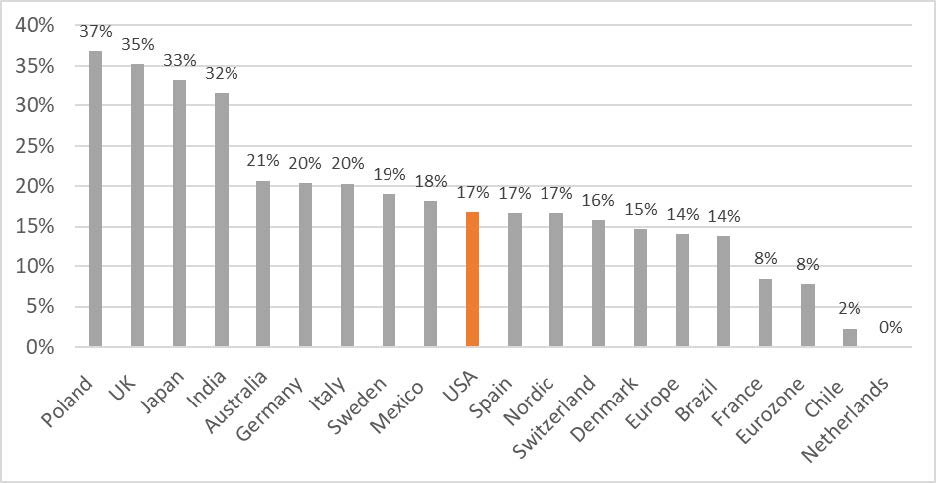

What is the Success Rate of Actively Managed Funds?

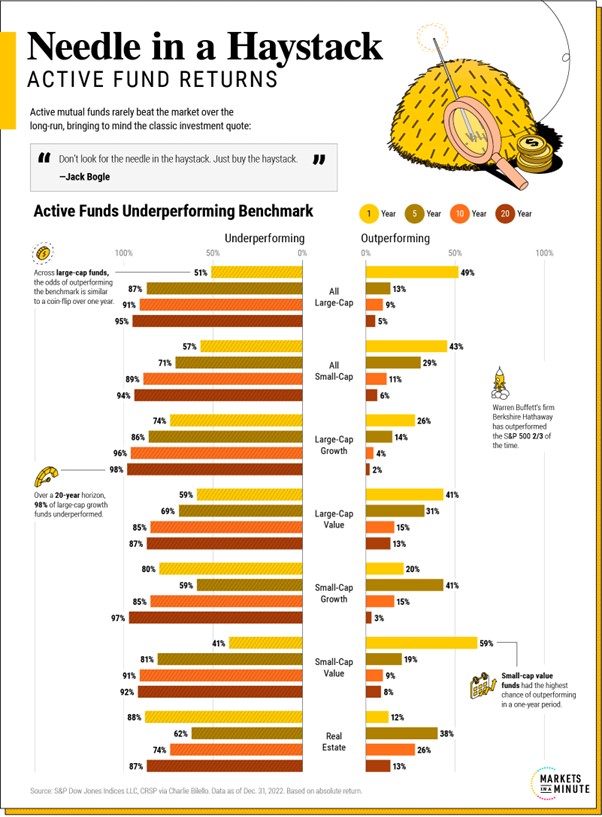

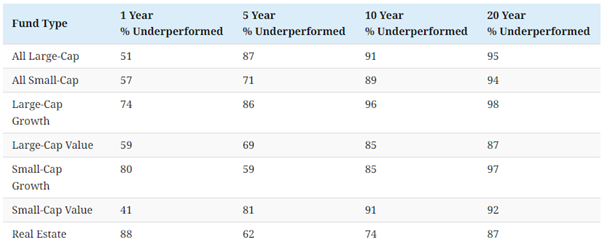

Over a 20-year period, 95% of large-cap actively managed funds have underperformed their benchmark.

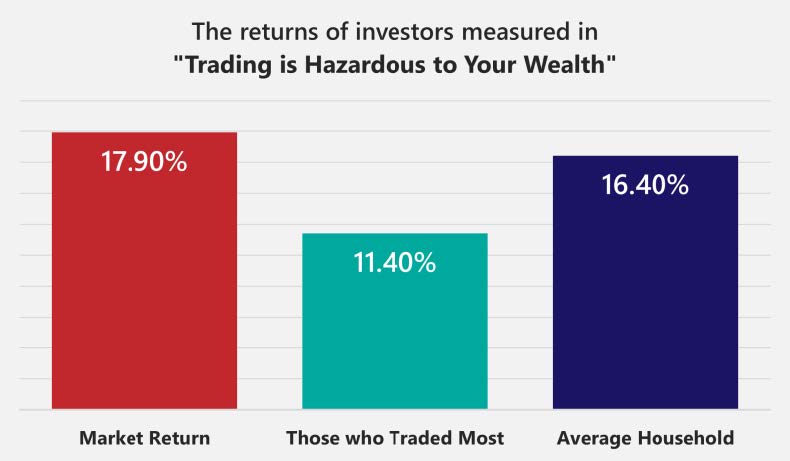

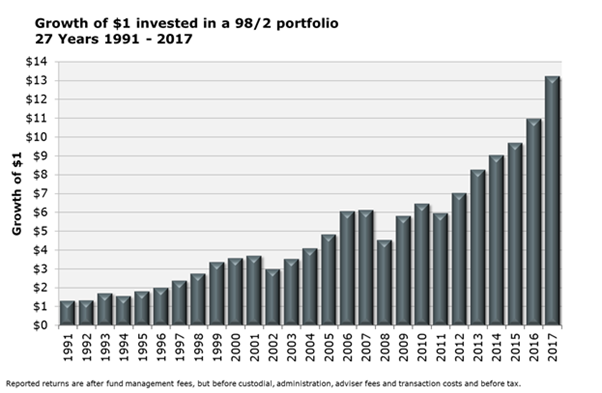

The above graphic shows the performance of actively managed funds across a range of fund types, using data from S&P Global via Charlie Bilello.

Missing the Mark: Actively Managed Funds

Several factors present headwinds to actively managed funds.

- Trading costs: First, fund managers will trade more often than passive funds. These in turn incur costs, impacting returns.

- Cash holdings: Additionally, many of these funds hold a cash allocation of about 5% or more to capture market opportunities. Unlike active funds, their passive counterparts are often fully invested. Cash holdings can have the opposite effect than intended—dragging on overall returns.

- Fees: Active funds can charge up to 1-2% in investment manager fees while funds that tracked an index passively charged just 0.12% on average in 2022. These additional costs add up over time.

Below, we show how active funds increasingly underperform against their benchmark over each time period.

As we can see, 51% of all large-cap active mutual funds underperformed in a one-year period. That compares to 41% of small-cap value funds, which had the best chance of outperforming the benchmark annually. Also, an eye-opening 88% of real estate funds underperformed.

For context, Warren Buffett’s firm Berkshire Hathaway has beat the S&P 500 two-thirds of the time. Even the world’s top stock pickers have a hard time beating the market’s returns.

2020 Market Crash: A Case Study

How about active funds’ performance during a crisis?

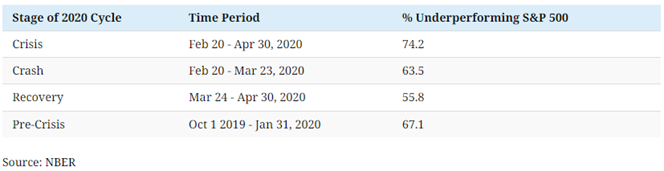

While the case for actively managed funds is often stronger during a market downturn, a 2020 study shows how they continued to underperform the index.

Overall, 74% of over 3,600 active funds with $4.9 trillion in assets did worse than the S&P 500 during the 2020 market plunge.

In better news, roughly half underperformed through the recovery, the best out of any market condition that was studied.

The Bigger Impact

Of course, some actively managed funds outperform.

Still, choosing the top funds year after year can be challenging. Also note that active fund managers typically only run a portfolio for four and a half years on average before someone new takes over, making it difficult to stick with a star manager for very long.

As lower returns accumulate over time, the impact of investing in active mutual funds can be striking. If an investor had a $100,000 portfolio and paid 2% in costs every year for 25 years, they would lose about $170,000 to fees if it earned 6% annually.

Published on May 4, 2023

By

What is the Success Rate of Actively Managed Funds? (visualcapitalist.com)

SHARE THIS POST

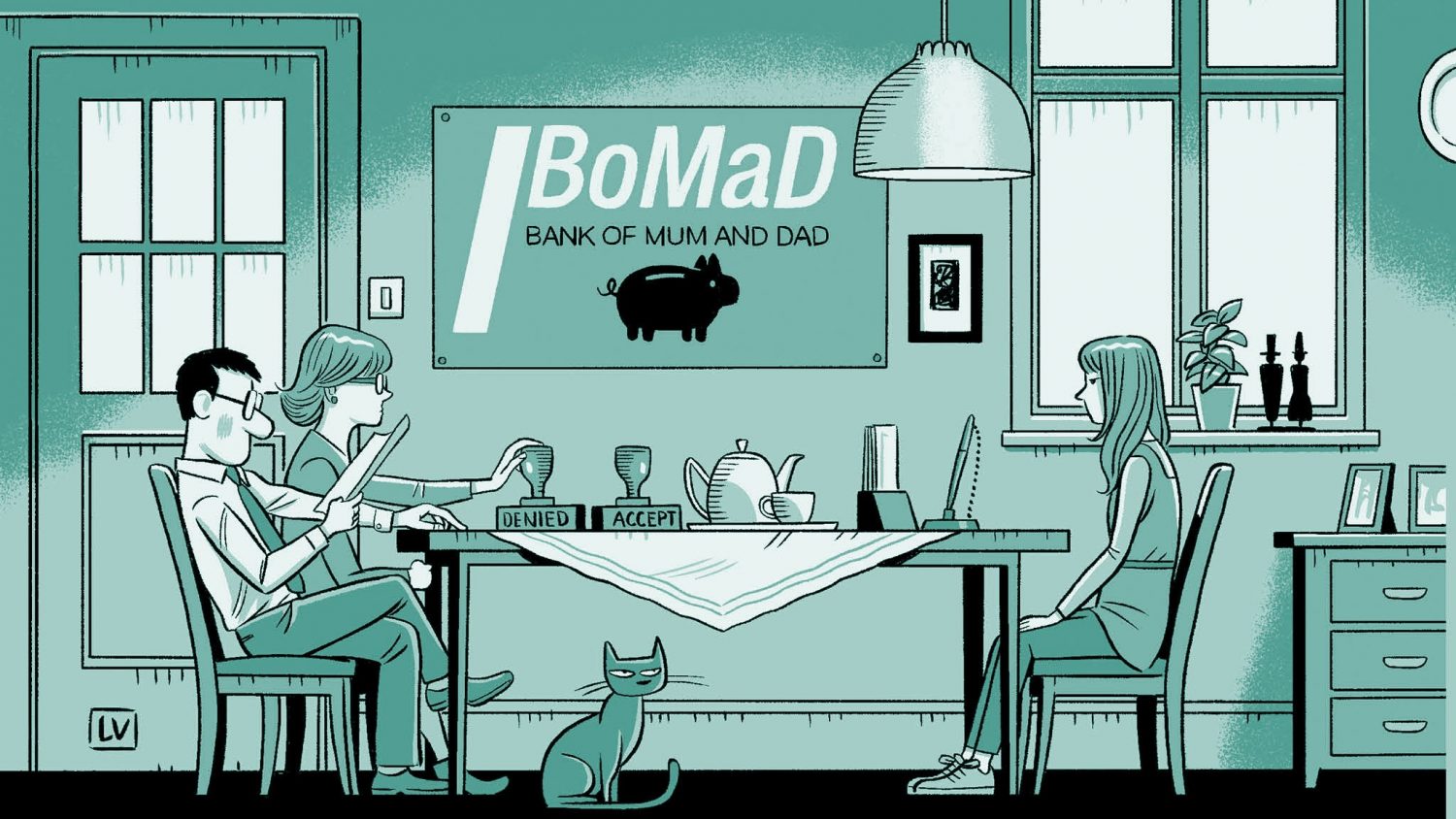

Helping Loved Ones Through Rising Rates

Are you, your children or loved ones, concerned about their mortgage as a result of the sudden rise of interest rates? Perhaps you may be concerned that there is a need to help someone financially when their interest rates reset?

If you’ve had those thoughts you’re not alone. Some investors are thinking the same. The sudden movement of rates is having an impact on society. And perhaps the most significant impact is on new homeowners who purchased their first home or upsized their mortgage on a new home right after COVID when rates were at historically low levels.

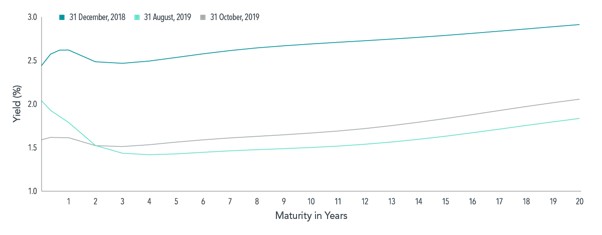

In May of 2020, just as the full impact of COVID was being felt and many of us were in lockdown, the Reserve Bank of New Zealand dropped the Official Cash Rate (OCR) to 0.25%. There was talk at the time of deflation and negative interest rates such as Europe has experienced. As it happened, the OCR stayed low for well over a year until about October 2021 when it began to rise all the way to 4.75% where the rate sits at the start of April 2023.

While our saver clients will certainly be relieved, if not happy, that they can once again earn a reasonable level of interest on their cash, bonds, and term deposits; for borrowers it is a different story. In May 2020 you could secure a loan for as little as 2.25% or slightly more for longer terms. Now those loans are starting to roll off the books and are being reset at much higher rates.

ANZ is currently offering a rate of 6.54% for borrowers with 20% equity and an ANZ transaction account. Other borrowers are looking at 7.14% for one year[1].

The impact of higher mortgage interest rates is substantial. Imagine in May 2021 you secured a two-year rate at 2.50% on a new home borrowing $800,000 for 30 years. Your fortnightly payments would be $1,458. Once you borrow at 7%, your payment increases to $2,455[2] a fortnight. That extra $1,000 per fortnight is a huge expense for many borrowers.

So, what can be done?

The key here is planning. Below we offer some real suggestions that we’d encourage any of our clients or their loved ones to consider and the sooner the better.

- Contact a professional and get the facts. Not all mortgage brokers are of the same quality. If you’re not sure who to speak to, contact us and we’ll put you in touch with someone. With or without a professional, find out what you owe, what you’ll likely be reset to and get a sense for how much additional interest you’ll pay per month or per fortnight. Use online calculators like the one on sorted https://sorted.org.nz/tools/mortgage-calculator.

- Act now as if you’ll need to cover that expense. For example, if you’ll have another $1,000 to cover each fortnight and you get paid fortnightly, take $1,000 immediately out of your account and place it in a special savings account. Now act for next two weeks as though the money isn’t there. Doing this allows you to simulate what it will be like to live without that money. Can you do it? If not then you’ll need to pull out your budget, leading to our next point.

- Budget. You’ll need to get a handle on exactly what your discretionary expenses are. For many of us they are holidays, eating out, streaming, gym memberships, even (gasp) coffee. You don’t want to give up any of those, but doing so may be a better trade off to not being able to make your payments. Sorted has a good budgeting tool if you need a place to start https://sorted.org.nz/tool/budgeting-tool

It’s possible after simulating your extra mortgage payment, you can’t make ends meet no matter what you do. There are other options to explore.

4. Negotiate with your employer. Often salary gets reviewed and updated in April. This may be the right time to talk to

your employer about a raise to keep up with inflation or better. Don’t just come asking for money though. Do some

research. If you know there’s more money available at other employers then bring that into the conversation. Ensure

you’ve written down your accomplishments. Don’t expect your employer to know them off hand. Ensure they know

you believe in the company and its direction and that you’re a team player, be confident and put your request in

writing.

5. Negotiate with the bank. With your mortgage broker, you can explore many different options. The sooner you

speak with the bank, the more options you’ll find available to you. Other banks may offer more competitive rates,

consider moving. Banks may be willing to offer you to pay interest only for a year or at most two years. Or perhaps

you can extend the term of the loan back to 30 years.

6. Consider other ways to raise money. If you’ve just bought a house and you have a spare room, there are people willing to rent especially in university towns. This could mean several hundred dollars a month which would make all the difference.

The point is, once you notice a short coming you can plan to do something about it.

Of course, the best way to deal with an unexpected financial downside is with unexpected financial upside. For example:

- When you’re on the other end and you renegotiate rates lower, keep the same payment.

- When you get a raise, top up your mortgage payment by the same percentage as your raise.

- When you get an unexpected bonus, use a pre-planned percentage of it to pay down your mortgage.

Using the upside to pay off debt more quickly, you create a buffer for the downside. If borrowers had been using these rules for a few years, they’d be in a better position to absorb the increased rates, perhaps without even changing their payment.

The main takeaway from this article is simple, if you have reason to be concerned about the impact of rising interest rates on yours, or a loved one’s financial situation or even emotional health, please share this article and let them know that there is help available. As advisers we’re willing to speak with the loved ones of our clients and we have connections to help point them in the right direction. With planning we can help get our homeowners through this difficult period.

[1] https://www.anz.co.nz/personal/home-loans-mortgages/loan-types/fixed/

[2] https://sorted.org.nz/tools/mortgage-calculator

SHARE THIS POST

Retirement Ready

It wasn’t so long ago that ‘retirement’ meant a hard stop in people’s lives. They would quit work, pick up the gold watch and head for the bowling green. These days, people don’t ‘retire’ so much as redirect their energy to any number of activities, including paid work, creative pursuits, volunteering or looking after grandkids. Getting ready for this major life change obviously involves having a financial plan to ensure you have sufficient income to do the things you want to do. But it also means being prepared for the emotional adjustment that comes with the end to full-time paid employment.

Having a Plan

A financial plan is only part of the preparation for retirement. An often overlooked area is thinking about how you will use all that additional time. Australian financial website Firstlinks surveyed their readers on what advice they would give those thinking about retirement. There are some useful ideas here.

A Retirement Checklist

Your retirement plan can be simple or complex. It’s up to you. But some things it should include are the timing of the transition, lifestyle and priorities, income and living costs and future living arrangements. Whilst the following may comment on some Aussie centric benefits, most of the Australian Securities and Investment Commission (ASIC) MoneySmart checklist items, apply to us in NZ too.

The Emotional Adjustment

If you’ve depended overwhelmingly on your professional career for your sense of self-worth, retirement can be something of a wrench. This is why making positive plans for how you will spend your time is so important. As this article explains, learning new skills and making new friends can be part of the plan.

Source: Jim Parker – Dimensional

SHARE THIS POST

The Year That Wasn’t

Jim Parker

Vice President – Dimensional

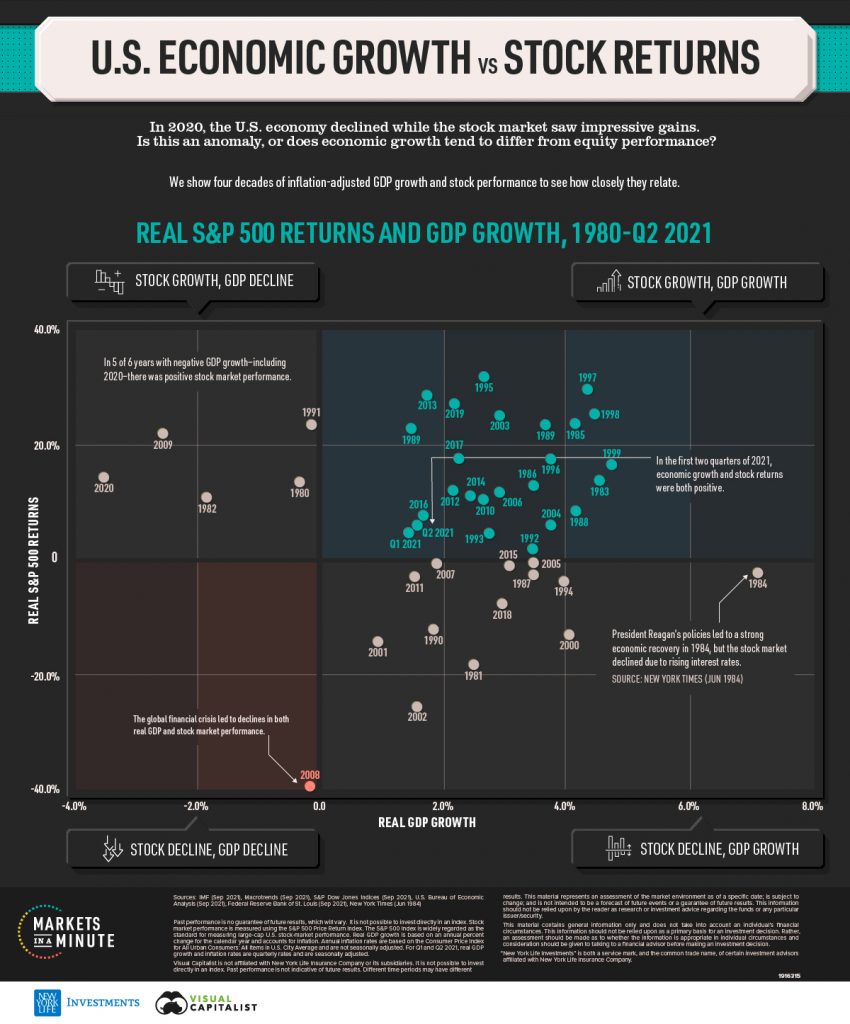

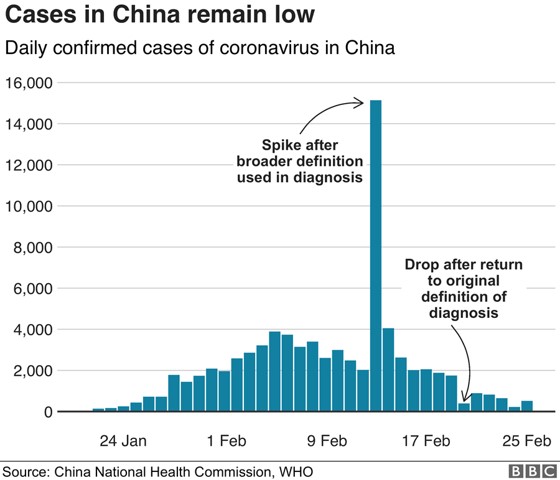

As an eventful year in markets nears its close, analysts are being asked about their

expectations for 2023. The media uses these surveys to generate eye-catching headlines,

but rarely does anyone go back to look at what they forecast last year.

Speculative articles about the future can be an entertaining diversion. But however

educated the guesses in these articles may be, these are still guesses and subject to

random and unpredictable events. Recent history has proved that repeatedly.

In January 2020, none of the dozens of forecasters interviewed by newswire Bloomberg

had a global pandemic on their bingo card of what might move markets that year. (1) In the

equivalent survey in January 2022, virtually no-one cited a land war in Europe. (2)

Back in late 2021, the enthusiasm for cryptocurrencies was a big story. Market leader

Bitcoin had reached record highs above $US68,000. One investment bank predicted it

was headed for $150,000 as it competed with gold as an alternative currency. (3)

The fortunes apparently on offer in cryptocurrencies were no more evident than in

coverage of up-and-coming crypto exchange owner Sam Bankman-Fried, hailed by one

publication in late 2021 as “the world’s youngest mega-billionaire”, at just 29. (4)

Less than a year later, however, Bankman-Fried’s $32 billion empire had collapsed with

his own substantial personal wealth almost entirely wiped out. (5) Bitcoin was down near

$20,000 and regulators were calling for greater scrutiny of the sector. (6)

Economic and interest rate forecasting is a tough business as well, and one that does not

appear to be getting any easier, judging by last year’s predictions.

Each year, the academic website ‘The Conversation’ asks a panel of esteemed Australian

economists for their individual forecasters for key economic and market variables for the

year ahead. (7)

The big debate this time a year ago was what would happen to official cash rates in 2022,

with inflation rising around the world.

Even so, two thirds of the 24-member forecasting panel expected the Reserve Bank of

Australia to leave cash rates at historically low levels, near zero, at least until the first quarter of 2023. Some did not expect any move until 2024, as the RBA itself had said.

Of course, we now know that inflation kept rising, confounding the expectation of central

banks that it would be transitory. As a result, the RBA began raising cash rates in May

2022 and did so another handful of times over the year, while warning of more to come.

As forecasting errors go, this was remarkable.

But it didn’t stop there. Perhaps reflecting their bad call on cash rates, the economists’

panel was convinced that underlying inflation, the measure targeted by the Reserve

Bank, would stop short of the top of its 2-3% target band in 2022.

As it turned out, however, inflation kept on rising and by the September quarter was

above 6% in underlying terms, twice as high as the economists’ year-end target. (8)

On currencies, the forecasters saw the Australian dollar staying roughly where it was back

in late 2021 in the low 70s against the US dollar. Wrong again, unfortunately. The AUD

kept falling through 2022, as the USD rose, hitting lows near 62c in mid-October.

On bonds, the panel was fairly sanguine, expecting Australian government 10-year bond

yields to edge up slightly over the year to 2.5% from 1.7%. Another miss here, too, as

yields kept rising through the year to reach around 4.2% by mid-October.

On the share market, macro economists tend to avoid making forecasts and about a third

of the panel declined to make a prediction. But of those who did there was a significant

dispersion in individual calls for the S&P/ASX 200 index, ranging from a gain of 10% to a

loss of 45%! The local market was down about 3% as of late-November.

On the economy generally, the economic forecasters were too pessimistic. Few of the

panellists expected Australia’s unemployment rate to fall much below its then historic

lows of 4.2%. But by mid-2022, the jobless rate had plunged to around 3.5%. (9)

None of this is intended to disparage the skills or professional standing of these

economists. Many are highly respected in the field. But they would be the first to admit

there is little science in forecasting financial markets or economies.

One can make assumptions about the future. But as we have seen many times over the

years, unexpected things can happen – wars, pandemics, inflation, recessions – that mess

up even the most carefully considered projections.

For the ordinary investor, the lessons here are familiar. The future is inherently uncertain.

Not even the experts are particularly good at predicting it. This means that basing your

investment strategy on somebody’s opinion, hunch or wish about what might happen

next year or the year after is not a sustainable or reliable approach.

The good news is you don’t need the powers of prediction to have a good investment

experience. You just need a financial plan that’s made for you and your goals, one that is

highly diversified and that makes allowances for periods like we have seen in 2022.

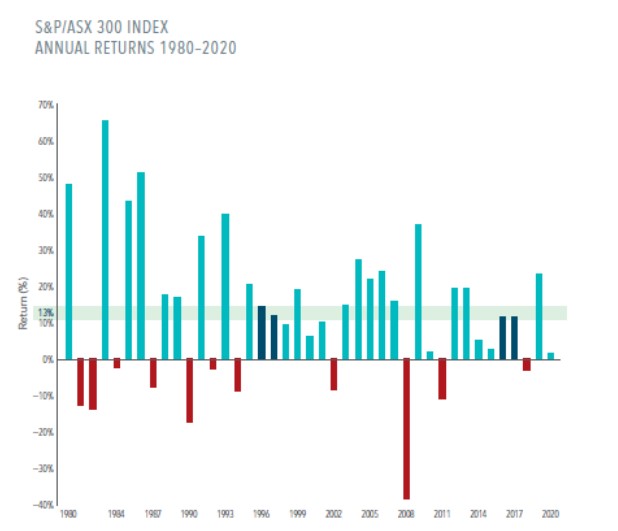

We know that over the long term, the share market has delivered a reasonable rate of

return, but it is not the same every year. Some years are much worse, some years are

much better. So to get that average you need to stick with it.

Humanity faces some challenges, it is true. But the flipside of challenge is opportunity

and the chance to create innovative solutions to the problems we face. Being a longterm

investor gives you the chance to share in the wealth created by innovation.

And you can do all of that without making a forecast.

- ‘Here’s (Almost) Everything Wall Street Expects in 2020’, Bloomberg, 2 Jan 2020.

- ‘Here’s (Almost) Everything Wall Street Expects in 2022’, Bloomberg, 3 Jan 2022.

- ‘Bitcoin Surges to Record High of More than $68,000’, The Guardian, 9 Nov 2021.

- ‘Inside the Hectic Life of Sam Bankman-Fried’, Business Insider, 17 Dec 2021.

- ‘FTX Collapse Being Scrutinized by Bahamas Authorities’, Reuters, 13 Nov 2022.

- ‘FTX Collapse Exposed Weaknesses in Crypto: Janet Yellen’, Yahoo Finance, 14 Nov 2022.

- ‘Top Economists Expect RBA to Hold Rates Low in 2022’, The Conversation, 30 Jan 2022.

- Consumer Price Index, Australian Bureau of Statistics, 26 Oct 2022.

- Labour Force Survey, Australian Bureau of Statistics, 20 Oct 2022.

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein. This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd. and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.Risks

Investments involve risks. The investment return and principal value of an investment

may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

This material is issued by DFA Australia Limited (incorporated in Australia, AFS License No. 238093, ABN 46 065 937 671). This material is provided for information only. This material does not give any recommendation or opinion to acquire any financial product or any financial advice product, and is not financial advice to you or any other person. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the Product Disclosure Statement (PDS) and for the Dimensional Wholesale Trusts the target market determination (TMD) that has been made for each financial product or financial advice product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to dimensional.com/funds to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.

SHARE THIS POST

It Will Never Happen To Me

According to recent articles, 3,400 people or more are injured on Christmas day – costing over $3million!!

New bikes, trampolines and other ‘toy’ incidents can be blamed for many of the incidents. Then there are the accidents involving one to many sherries on Christmas Day!! And of course, the obligatory slip of the knife events when carving the turkey. Dropping a turkey or ham on your foot is also something more than one of us does each year, apparently!

Politics aside, as we know our health system is under severe stress, we are fortunate in this country to have the safety net of ACC and being able to turn up to Accident & Emergency and be treated.

Beyond accidents though, there are many situations where personal insurances play an important role in ensuring that we can survive financially if we are unable to work through illness, to protect our family’s financial security if we die, or to get private treatment if needed and then to avoid having to set up a GoFundMe or Give A Little page to give us access to an unfunded drug.

Unfortunately, it could happen to you, so keeping on track of the level of personal insurance cover you need is important – we are here to help you manage the level and types of cover you need, affordably.

This Christmas though, stay safe – and don’t try any technical moves on the new trampoline!

Food, fun, and festive fumbles (acc.co.nz)

Christmas injury claims cost more than $1m over last decade (1news.co.nz)

SHARE THIS POST

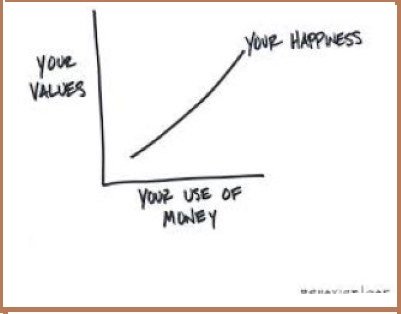

Do You Know What Is Important To You And Why

A few times recently we’ve had the privilege to be part of a conversation with clients and friends over a coffee or glass of wine, about what is important to us in life and why.

This has brought up some very interesting topics and as you can imagine, this can go pretty deep!

Importantly though, this is about challenging ourselves to consider these deeper parts of ourselves, taking time to think about who we are, what we want in life, what our values are, what we would like our legacy to be etc.

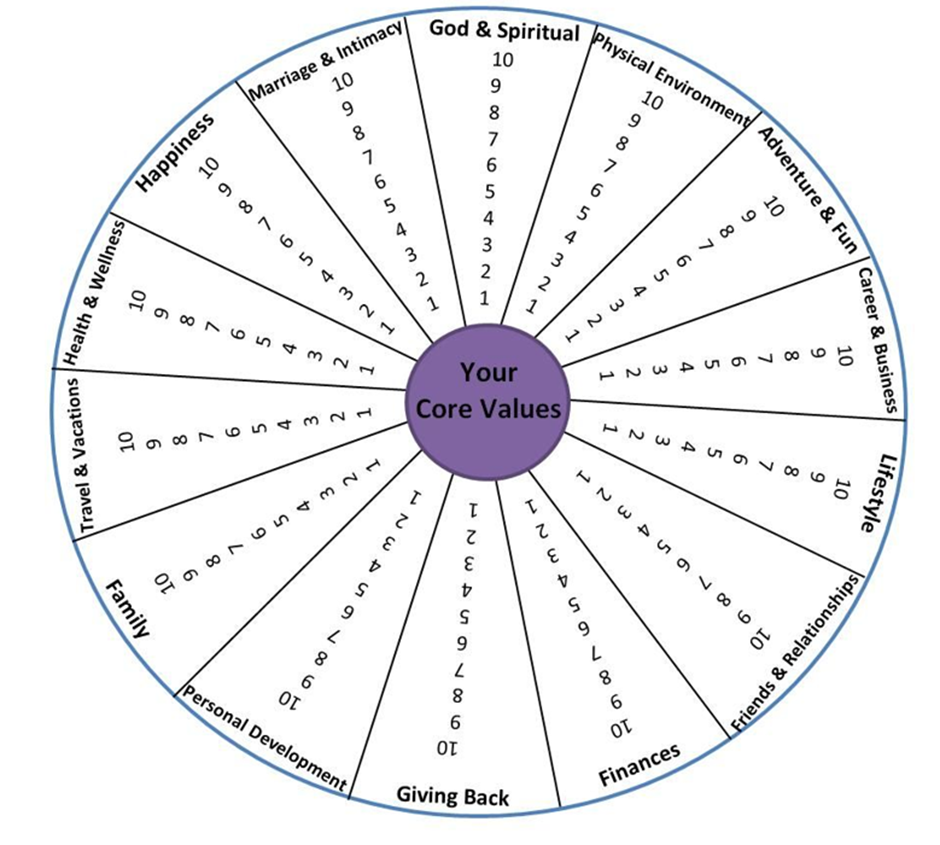

As we are coming into summer and can hopefully give ourselves time to recharge our batteries before 2023 starts in earnest, we would like to share with you the Wheel of Life. You may have heard of this before, or even done this exercise several times throughout your life as we have. There are several variations of this if you google it, although we liked this one because of the many areas of life it covers, so this image below may be a good start for you.

If you score yourself in each segment, from 1 being low and 10 being high, then join the dots, it helps focus our minds on any ‘gaps’ in our lives. These ‘gaps’ and low scores may be fine and sit well with us, however, if not, and you wish to work on increasing your score in that area, you can do something about this if you want to.

As the new year approaches, instead of making new year resolutions many of us never keep for long, maybe use this Wheel of Life to start yourself on a journey to fill in those ‘gaps’ you want to work on, and do not be afraid of seeking support from friends, family and others where needed.

This can be confronting we know, however, if we change our internal dialogue from negative and fearful thoughts, to saying ‘hey, I’m really going to work on this so let’s go!”, maybe you will find out something amazing about yourself you never knew. And remember, as you do this, think deeply about your ‘why’ a certain area is important to you, as this helps us come to understand our core values in life, if you don’t already know them of course!

If you score yourself high in each area, then congrats, you’re in a great space right now!!

SHARE THIS POST

Five Ways To Combat Financial Stress During Uncertain Times

Here are five steps you can take to reduce financial

stress and get your financial health, wealth and

wellbeing back on track.

1. Take stock of your situation. One way to help

reduce financial stress is to fully understand how

much money you have, how much is coming in each

month, and what bills are due. To get a full view of

the month, try mapping it all out on a monthly

calendar. Mark the date or dates that you expect to

receive income, as well as the due dates for your rent

or mortgage, utilities, credit cards, tax payments or

other fixed expenses. This will help you understand

your cash flow.

If most of your bills are due within a one-week period or concentrated during a particular time of the month, it may make sense to contact your creditors to see if you can change some of your due dates or get an extension and preserve your cash flow.

2. Track your spending. If money is tight, try tracking your spending for a month or two to see how you’re

spending it. Write down each purchase and each bill paid in a notebook or spreadsheet. After your tracking period is complete, go through the list and see which expenses can be cut and which are essential. From there, try developing a monthly budget and sticking to it

3. Don’t try to make financial decisions all at once.

It’s easy to get overwhelmed when faced

with mounting bills and not enough income

to cover them. Instead of looking at your

financial problems in the aggregate, try

tackling them one at a time and spreading

out your decisions.

4. Remember your goals. Just because money

seems tight right now, doesn’t mean your financial

and life goals are any less important. Besides saving,

what are some other ways you can stay

on track and make progress? Some people

find that doing freelance work, selling

unwanted possessions or relocating to a

less expensive home can help generate extra

cash for the future.

5. Seek the guidance of a financial advice

professional. Financial advice professionals

work with you to understand your goals and aspirations. They provide recommendations and advice relevant for your situation and ensure that you have the knowledge you need to help you make decisions at critical points in your life. Accessing quality financial advice will help you be better prepared for the future,

more comfortable with your financial position and confident in your financial decision-making. To find a

financial adviser in your area visit area visit

www.financialadvice.nz

SHARE THIS POST

Better Financial Behaviours By Those Who Receive Professional Financial Advice

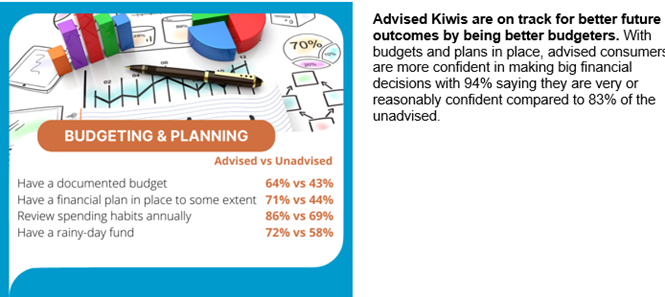

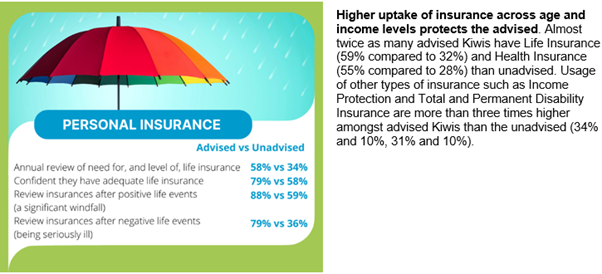

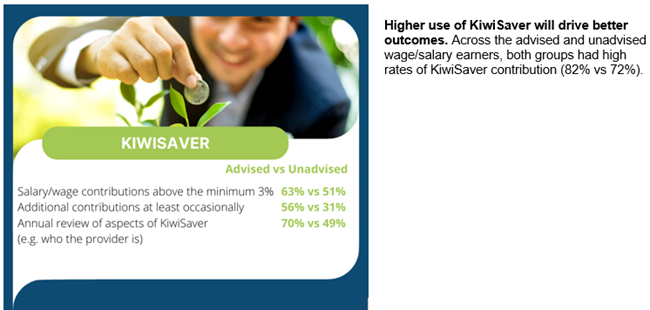

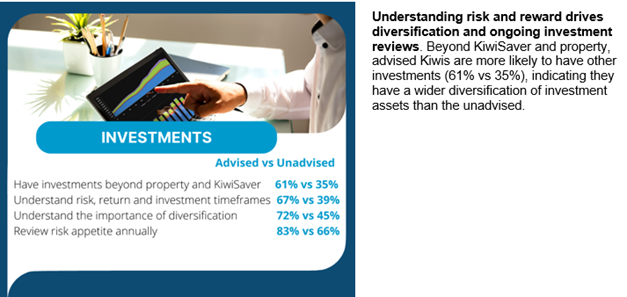

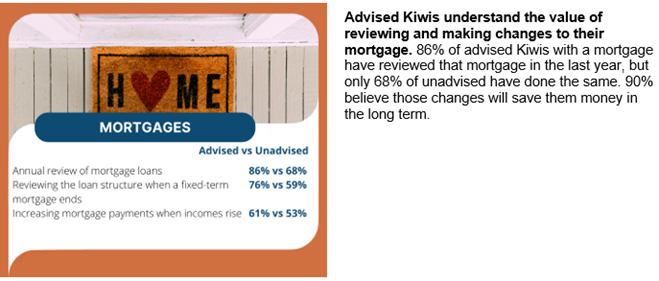

Kiwis who seek out and receive professional financial advice, exhibit good financial behaviours more often than unadvised Kiwis. According to Financial Advice New Zealand report 2021, advised Kiwis are more prepared for retirement, feel better about their finances and are more comfortable making big financial decisions.

Building on the research report from 2020, Trust in Advice, which clearly showed that financial advice and advisers are trusted and highly valued, the Better Behaviours report measures the extent of positive financial behaviours demonstrated by advised Kiwis compared to those who are unadvised.

The independent and comprehensive survey of 2,000 people repeated many questions from the 2020 survey to determine the 2021 Financial Advice NZ Wellbeing Index* and to compare it to the 2020 results. In addition to these questions, we asked Kiwis about their financial plans, what financial products they had, when they last reviewed aspects of each product, and if they made changes. It also asked if they thought those changes would make a long-term difference to their financial wellbeing.

The results are clear – advised Kiwis exhibit better financial behaviours:

– More than two thirds of advised New Zealanders say that advice has led to outcomes such as a better understanding of the risks of their financial plan (77%), a better understanding of how to achieve financial goals (74%), and they are better equipped to actually stick to these financial plans (70%).

– The vast majority of advised consumers say that their advice relationship is meeting their needs. When asked whether the service provided by their adviser met their needs, a strong majority (91%) said yes to at least some extent.

– More than two thirds of advised New Zealanders (67%) say that their financial security has improved at least slightly as a direct result of receiving financial advice. Further to this, sizeable proportions also say that advice has had a positive impact on their mental health (46%), family life (40%), and even on their physical health (25%).

The Better Behaviours results clearly illustrate that advised Kiwis are more likely to have a documented budget and financial plan, to review their financial products regularly, to understand risk vs return, and to take-up and cancel insurance products when appropriate. They are also more likely to have positive mortgage behaviours, setting themselves up to save interest and carve years off the life of their mortgages.

Across the board (mortgage advice, investment advice, insurance advice and financial planning), quality financial advice has given Kiwis the tools to think about their finances in a pro-active way, given them more financial confidence and control, and has had a significant effect on their sense of financial wellbeing.

Download the full report here , however, for a snapshot of the results:

Source: https://financialadvice.nz/better-behaviours-2/

SHARE THIS POST

20 Ways To Jump Start Your Financial Future

World Financial Planning Day is a global event to help raise awareness of the value of financial planning which takes place on 5 October. It’s the perfect opportunity for you to take positive steps to toward controlling your financial health, wealth, and wellbeing – now and in the future.

How can you improve your financial well-being on World Financial Planning Day? Following is a

comprehensive list that includes some starting points, as well as some more complex strategies for

those who want to make this year the start of a longterm commitment to financial success.

1. Improve your financial literacy. Don’t know

much about managing your money? Financial Advice

New Zealand and Sorted have some great articles,

tools and resources to help get your started.

2. Start a money journal. Explore your attitude

towards money, your hopes and fears and your

dreams for financial success. Doing so can help you

crystallise your long-term goals so you can make a

plan for the future.

3. Write down your long-term life and financial

goals. Include them in your journal, along with a

timeline for achieving them.

4. Reconcile your bank accounts. Check your bank

account debits against the payments you’ve made,

and make sure any pending bills are either paid or

scheduled.

5. Compare interest rates for savings accounts.

This is a perfect place to start building or expanding

your emergency fund. While you’re at it, commit to

saving a specific dollar amount or percentage of your

income each month.

6. Make an extra credit card payment. If you carry

a balance on your credit cards, use World Financial

Planning Day to start paying down the card with the

highest interest charge.

7. Determine your net worth. List your assets (what

you own), estimate what each is worth and add up

the total. Next, list your liabilities (what you owe), and

add up the outstanding balances. Subtract your

liabilities from your assets to determine your net

worth.

8. Estimate how much money you need to retire.

Wondering how much money you need to live

comfortably in retirement? Use a free online

retirement calculator to figure out a rough estimate.

One to try: sorted.org.nz/tools/retirement-calculator/.

Can you afford to bump up your contributions to

your KiwiSaver? Are you in the right fund? Seek

advice from a financial advice professional to get the

most from your KiwiSaver.

9. Organise your important household and

financial accounts. Would your loved ones know

how to run your household or understand your last

wishes if you became sick or injured, or died

suddenly? Use World Financial Planning Day to start

organising your important documents and accounts,

store them securely and share their location with a

family member, financial advice professional and/or

attorney.

10. Create a budget and track your spending. To

get a handle on where your money is going, try

creating a budget and tracking your spending.

11. Automate your savings. One of the least painful

ways to save is to automate the amounts you want to

set aside each month so you won’t be tempted to

spend them.

12. Put your money to work by investing

Term deposits, shares, property, KiwiSaver, managed

funds – sound intimidating? It’s really not. An

investment adviser can help you to determine your

investment goals and find the right balance (between

risk and return). Also, you don’t need to have a lot of

money to invest. Investing is for everybody!

13. Get insurance advice. Get the right insurance in

place to protect what you value most – your lifestyle,

your family your income, your business, your

mortgage, and/or your retirement – in the event the

unexpected happens. An insurance adviser can help

you choose the best protection plan for your needs.

14. Look for ways to lower your monthly bills. As

contracts for things like your mobile phone, cable

service or home security system expire, do some

comparison shopping to see if you can reduce your

monthly spend. You may even be able to negotiate a

lower rate with your current provider.

15. Make some extra money by selling unwanted

items. Looking for a way to reduce clutter and make

some quick cash? Explore the many online tools for

selling your unwanted items. Before doing so, be

sure to review secure ways to handle payment and

delivery, and research common scams.

16. Create a personal document retention policy.

Learn how long you should keep important

paperwork, such as contracts, loan documents, tax

returns or account statements. Create a system to

purge documents you no longer need, and scan and

save the ones you need to keep.

17. Talk money with your child. Does your child

understand the concept of saving money? Use World

Financial Planning Day to help your child open a

savings account and understand the basics of paying

bills and building credit.

18. Start an education/tertiary savings fund for

your child. If you are considering private education

for your child/children and want to help fund their

tertiary education, start a separate savings account

as early as possible, so when the time comes you

have a nice financial buffer to achieve this goal.

19. Create or update your will. If you have a will

already, use World Financial Planning Day to review

and update it as needed. If you need a will, use the

day to schedule an appointment with an attorney or

appropriate estate planning professional to create

one.

20. Make an appointment with a financial advice

professional. Those who get professional financial

advice are more likely to feel happy with their

financial position and better prepared for the future

than those who don’t. They feel more confident in

their financial decision making, in control, and clearer

about their finances. Visit financialadvice.nz to find a

financial advice professional in your area.

Source: Financial Advice New Zealand –

SHARE THIS POST

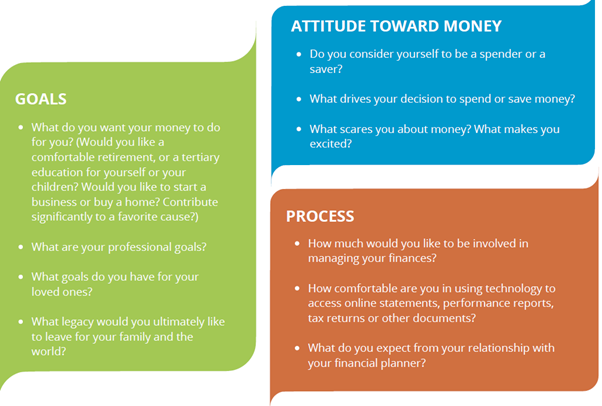

Meeting With Your Financial Advice Professional For The First Time?

Congratulations! You’ve decided to take control of your financial life. You’ve researched your options, asked a lot of questions, and found the right financial advice professional to help you plan for your financial future. As you prepare for your first meeting as a client, it’s likely you have even more questions, and if so, you’re not alone. Many clients of financial advice professionals aren’t sure what to expect, how much to divulge, or even what documents to bring to their first official meeting.

While every financial adviser and adviser practice is

different, most follow a common general framework

based on the six-step financial planning process. The

first step often involves something called a ‘discovery’

meeting, in which you and your financial adviser will

form a basis for your relationship. It’s an opportunity

to build trust, understand problems and priorities,

and establish a roadmap for progress toward your

financial and life goals.

Financial advisers and their business often have an

established process that includes providing a

checklist of required documents and information

they need to get an accurate picture of a your financial situation. While it may seem a bit

overwhelming to share your most important financial details with someone you don’t know well, it’s really no different than consulting with a physician on your health. When you engage a financial advice professional, you are working with someone who is placing your interests first.

THE BIG PICTURE

When your financial adviser conducts a discovery meeting, they will probably ask questions not only about your financial situation, but also about your personal interests, family and lifestyle. Often, a person’s interests, family or lifestyle can influence their financial goals and decision-making, so having a good understanding of your background may help the financial adviser understand your willingness to take on risk, or the triggers that will make you excited or spark your concern. The goal is to help you create a plan that will serve you well in good times or bad, so you always feel confident about reaching your goals.

Thorough financial advisers have a process to securely gather their clients’ information, analyse it, and integrate their findings into a set of recommendations. After receiving and discussing the recommendations from your financial adviser, you will discuss how the recommendations can be implemented, and the role each will play in carrying

out the plan. The more honest and direct you are at the beginning of the relationship, the better your financial adviser can help you create a sound, actionable plan to help

you reach your goals. Although you might be hesitant to discuss embarrassing financial mistakes you have made in the past, it’s important for you to share those so your financial adviser can address any consequences of those decisions.

PREPARE FOR YOUR FIRST MEETING

Before attending your first meeting with a financial adviser, take an hour or two to prepare yourself with answers to these potential questions:

GET ORGANISED

Your financial adviser may also ask you to bring certain documents to your first meeting. Those

could include:

- Bank statements from the past year

- Other financial statements, such as loan documents

- Insurance policies

- Tax returns

- Pension or retirement savings account information

- Estate planning documents, such as a will or a trust

- Brokerage statements

A RELATIONSHIP FOR LIFE

Although it may seem like a significant time investment or an emotionally taxing experience, being well prepared for your first meeting sets the tone for a successful, trusting, long-term relationship with your financial adviser. The more your adviser knows about your history, your family, your interests and your financial situation, the better they can help you achieve the financial well-being you and your loved ones deserve.

Some financial advice practices provide a checklist with secure links to enable clients to upload their information prior to the meeting, but you may also bring the actual documents with you, depending on your comfort level. Whichever option you choose, be sure to label your documents and clarify any information that could be confusing.

SHARE THIS POST

Some good news for once!!

With all that is happening around the world, where media often focusses on the doom and gloom, it’s a refreshing change to hear the good news and to know there are some amazing advances going on in the world for the greater good!! Have a read of the latest round-up & check out the videos – some very inspiring stuff!

Source: Future Crunch https://futurecrun.ch/

Give a damn