BOMAD

Our world in 2019 is full of acronyms. For a long while we have had SKI (Spending the Kids Inheritance) where retirees are no longer focussing on protecting assets for the children to inherit. Instead, now that 70 is the new 60, they are out there travelling further and having fun.

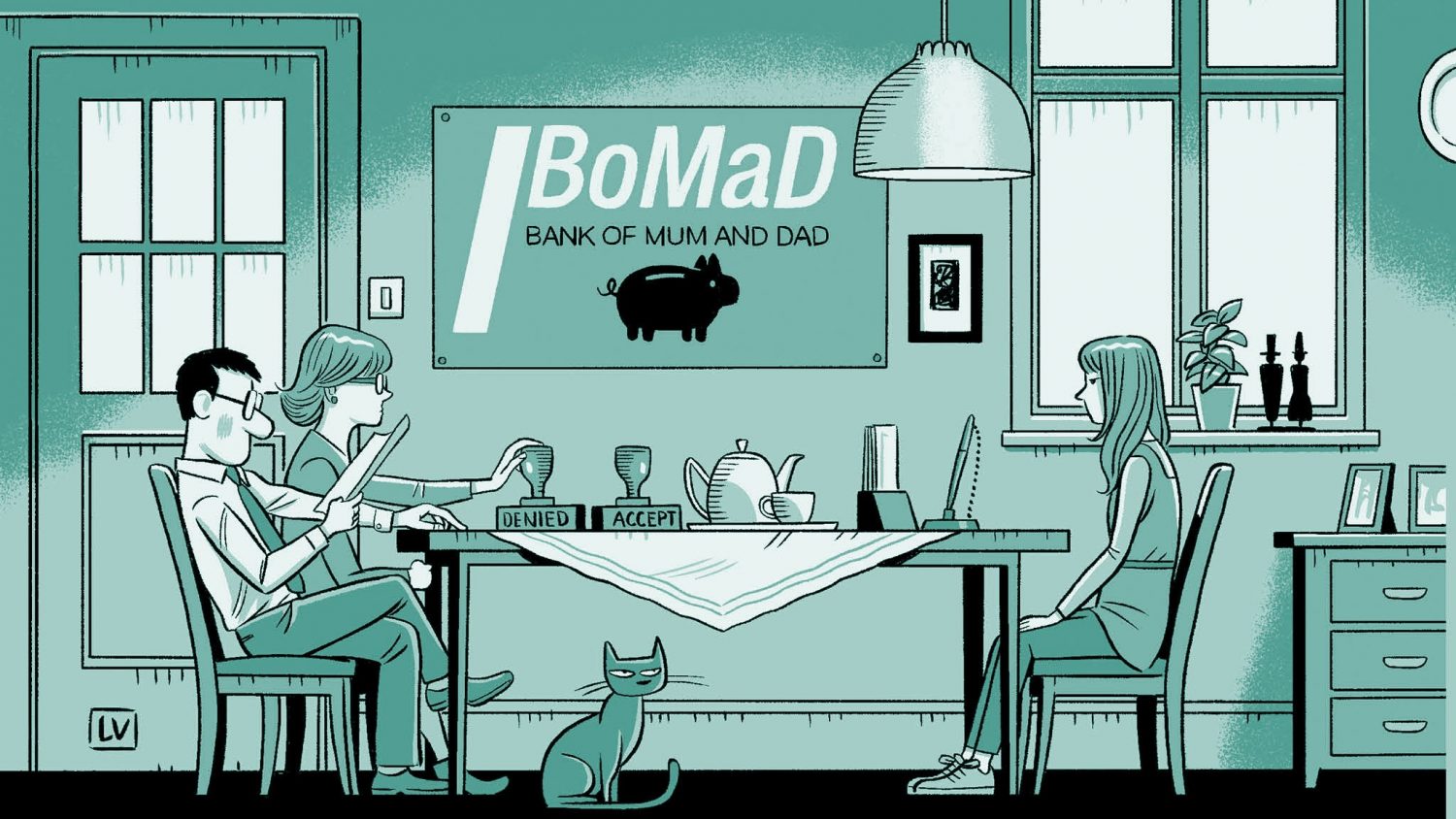

But as the property markets continue to rise and first home ownership becomes more and more of a struggle for our children, BOMAD is becoming ever popular. The Bank of Mum and Dad is often the only option they have to get enough of a deposit together to buy somewhere.

As families gather for Christmas and we take stock, looking back over what we may have achieved and make plans for the future, it is often the time the topic of helping the children into their own home gets discussed. Whilst this can be helpful if done properly, we are here to play devil’s advocate!

- None of us know what is around the corner: We might feel that we are sitting pretty with enough funds in the bank or our investment portfolio to see us through but we need to factor in the unexpected. When our clients ask us our advice on whether they should gift or even lend their children a deposit, we look at the bigger picture. What happens if one of you die? Are you relying on two NZ Superannuation payments and the money left in the bank to support you throughout? What happens when one of those payments stops? Can you survive financially? It is important that your own financial security is exactly that, secure, before you consider helping – unless the children will be happy to have you live with them in the future!

- Get it in writing: our children won’t ever let us down will they? We all believe our children will be our friends forever. Sadly relationships often break down for a myriad of reasons and any money you have lent needs to be protected through legal documentation. It is important that you get legal agreements in place.

- Without proper agreements your children’s partners, whether current or future, might become entitled to half of the money you have helped them with.

- Sometimes a loan can be an option, and often it is intended that the money given is in fact a loan. No documentation is put in place on occasions for this loan, as this may complicate and restrict any lending the bank is prepared to offer the children, as the loan repayments need to be factored in to the borrowing affordability when looking to the bank for other lending. However, with no signed agreements, there is no recourse for the parent, and if the children have relationship issues you can potentially say ‘goodbye’ to at least 50% of your money

- It is not unusual for some parents to take on loans themselves to help fund the children – this is a high risk scenario and could easily jeopardise the parent’s home ownership and security.

- Giving them money now might mean that you do not qualify for Residential Homecare Subsidies down the track if WINZ believe you have deprived yourself of that money. If your son or daughter cannot pay you back or subsidise any care home fees, you might find yourself in trouble and with limited options.

- Many perceive that the easiest option is to act as a guarantor for the loan as they do not have to part with any physical cash. However, these are far reaching agreements and you could find yourself responsible for the full loan repayments if your son or daughter defaults

- Can you help all of your children? If you gift one child the deposit for a home, are you going to be able to do the same or similar for their siblings? Inequality in how you treat them can be a sure-fire way to create family tensions

In an ideal world, we would all want to see our children financially settled however, we need to ensure that any help we give does not negatively impact our own long-term financial security.

It is important to take legal advice and have contractual agreements drawn up. Getting the children in front of a Financial Planner first is also a good idea, as perhaps they can work on a plan which doesn’t involve BOMAD and as parents, you can go SKI ing instead!