Category Archives: Children & money

We hope this message finds you well and in good spirits as we approach the holiday season. As we gather

It wasn’t so long ago that ‘retirement’ meant a hard stop in people’s lives. They would quit work, pick up

World Financial Planning Day is a global event to help raise awareness of the value of financial planning which

We are living in a time of extreme uncertainty and the anxiety that comes along with it. Against the backdrop

By Romana Bell Life is not always a sea of calm, but rather, at stages we will find ourselves in rough sea and

Whilst the stock markets and your portfolios may be volatile, the usual story of just ‘stay in your seats’ and

Whilst there is always something happening around the world that feels like its in turmoil, when it comes to investing,

A colleague recently posted a note on his LinkedIn profile, reminding me the value of time. Take a look at

My dad was a mechanic – a pretty good one from all accounts. That’s him in the photo. He’s always

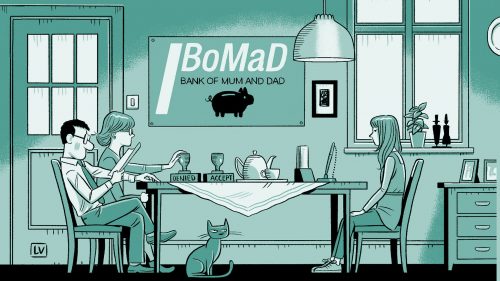

Our world in 2019 is full of acronyms. For a long while we have had SKI (Spending the Kids Inheritance)

So picture this: You’re a receptionist at, say, a hotel. Someone walks in and says they found a lost wallet

We were honoured to be a sponsor again at this year’s Festival of Disability Sport in March and would like

A friend recently returned to his parked car to find it had been sideswiped. Now, every time he calls the

Encourage your children to work for their pocket money. When they are old enough, possibly around fourteen, encourage them to