Category Archives: Investing

It may feel like we are living in extremely uncertain times, and that we now lack control over many important

Many people think they need to have a large lump sum of money to invest before seeking advice from a

We hope this message finds you well and in good spirits as we approach the holiday season. As we gather

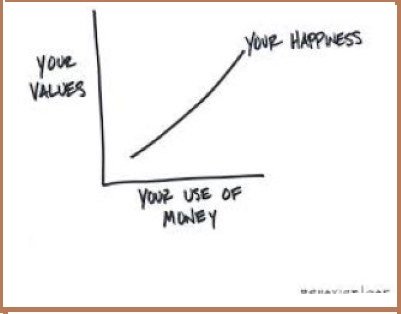

Just as a chef meticulously selects ingredients to create a masterpiece in the kitchen, achieving financial success requires careful planning

The United Kingdom’s Supreme Court has delivered an important judgement holding that where a customer has unequivocally authorised and instructed

Wills and Enduring Power of Attorney documents are among the most important legal documents, but are often overlooked. Everyone from

As part of the Budget earlier this year, the Government surprised us with an announcement that it would raise the

As our clients know, we prefer to refer to evidence around how best to invest money, and there are many

World Financial Planning Day is a global event to help raise awareness of the value of financial planning which

We are living in a time of extreme uncertainty and the anxiety that comes along with it. Against the backdrop

By Romana Bell Life is not always a sea of calm, but rather, at stages we will find ourselves in rough sea and

Whilst the stock markets and your portfolios may be volatile, the usual story of just ‘stay in your seats’ and

Whilst there is always something happening around the world that feels like its in turmoil, when it comes to investing,

By Karen Umland, Senior Investment Director and Vice President, Dimensional. https://au.dimensional.com/ Recent conflict between Russia and Ukraine is an important

If I could have just one more day I’d remind myself again to play For life is not about just

One of the most persistent debates in the investment industry is whether investors are better to use passive or active

We have pleasure in linking you to an article provided by Belly Gully on the changes announced by the government

Gender equality has yet to be achieved in terms of financial planning, even though women’s wealth has been growing rapidly

The Research The Financial Resilience Index uses five key financial indicators to gain insight into how Kiwis feel and think

We have all heard of ‘walls of worry’ and in the investment world, the media and all the hype focus

Dec 19, 2019 EQUITY INVESTING INVESTMENT PRINCIPLES The year 2019 served up many examples of the unpredictability of markets. The

In recent weeks, concerns have grown about the potential effect of a spreading coronavirus on the global economy and on

Maybe we will have a recession, maybe we won’t—but be wary of predictions on how markets will behave. It’s a

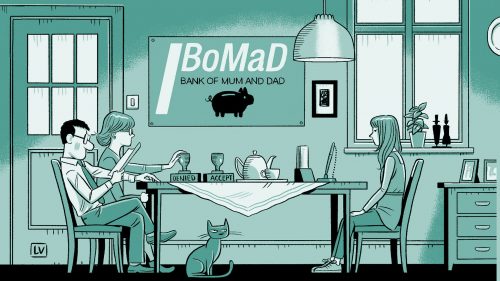

Our world in 2019 is full of acronyms. For a long while we have had SKI (Spending the Kids Inheritance)

It’s been a banner year for New Zealand sport, with a world championship win in women’s netball, the narrowest of

So picture this: You’re a receptionist at, say, a hotel. Someone walks in and says they found a lost wallet

Garrison Keillor is a US author who created a fictional town for a US radio show. The town was called

We get asked quite a lot about whether to invest in a rental property for income and future capital gain,

When stock markets were falling sharply late last year, the media was full of analysis of why it was happening

In the first three weeks of January 2018 alone the S&P 500 crossed ten new record closing highs in 13

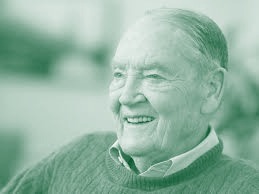

Jack Bogle, the legendary founder of Vanguard, passed away 16 January 2019 at age 89. He may not be the

Susan B Anthony, who led the fight for women’s suffrage in the United States, once said, “Independence is happiness”. She

Does your NZ family trust have UK tax obligations? If your family trust has a ‘UK tax connection’ the trust

The 1980s television series “21 Jump Street” launched Johnny Depp’s acting career; “Edward Scissorhands,” director Tim Burton’s dark Gothic fairy

Savouring a vintage wine is one of life’s great pleasures. But often overlooked in the joy of consumption is the

And the winner is … who? Marc Lore was a successful businessman and entrepreneur by pretty much any standard. He

‘How the financial wobble will hit your back pocket’ ‘Volatility now the new norm’ ‘Keep calm and enjoy the

So the decision has been made and we have a new Prime Minister eager to form our government for the

‘How’ relates to process. It’s not just what you invest in, but the approach you take to investing. This means

The media locks in on a particular ‘hot’ sector. In the late 1990s, it was technology. In the mid-2000s it

How many times do investors think that they or their advisers know which funds or stocks to pick and when

Spending more money than we earn It is often during our middle years, that we are nearing, or are at,

We regularly get asked “Is it worth me having a Trust anymore?” As you would expect from a Lawyer, the

Has your family trust passed its use by date? After all, there have been some big ones challenged through the courts where

If you want to get really high returns from investing, you have to find the best stocks – well, that’s

There are many myths surrounding investing. Below are 5 of the most common ones we encounter at G3:

On April 6, 2015, CNBC host and best-selling author Jim Cramer wrote an article: “Jim Cramer’s Picks —

Download the pdf to read: A Long Term Lesson in Residential Property as an Investment

One step at a time. One summer in college I interned at an investment bank. It was the worst job

A recent article I read reminded me of the importance of investors understanding the crucial factors