Category Archives: Trusts & Estate Planning

Many people think they need to have a large lump sum of money to invest before seeking advice from a

We hope this message finds you well and in good spirits as we approach the holiday season. As we gather

The United Kingdom’s Supreme Court has delivered an important judgement holding that where a customer has unequivocally authorised and instructed

Wills and Enduring Power of Attorney documents are among the most important legal documents, but are often overlooked. Everyone from

As part of the Budget earlier this year, the Government surprised us with an announcement that it would raise the

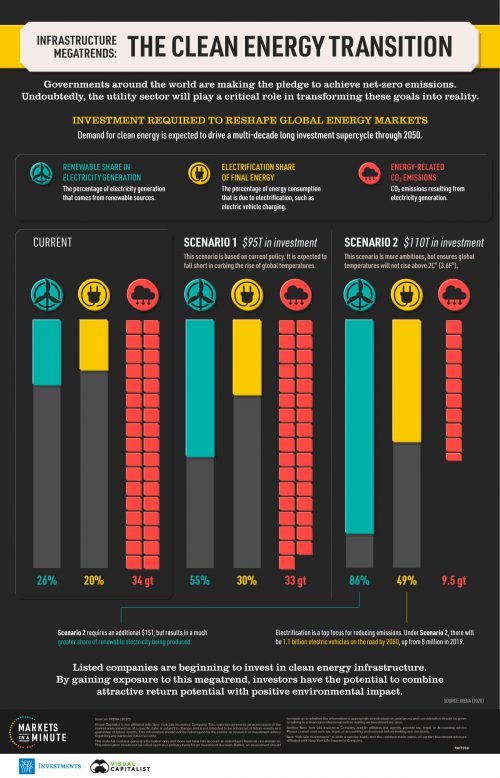

As our clients know, we prefer to refer to evidence around how best to invest money, and there are many

We are living in a time of extreme uncertainty and the anxiety that comes along with it. Against the backdrop

By Romana Bell Life is not always a sea of calm, but rather, at stages we will find ourselves in rough sea and

Whilst the stock markets and your portfolios may be volatile, the usual story of just ‘stay in your seats’ and

Whilst there is always something happening around the world that feels like its in turmoil, when it comes to investing,

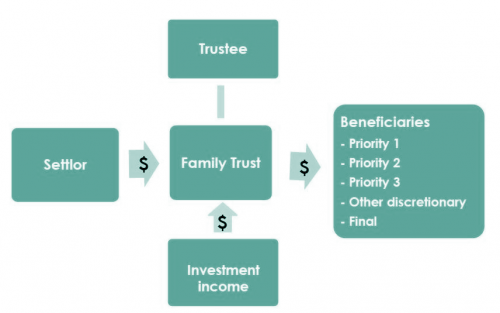

Trust Act changes – whilst we have been aware of modifications and additional obligations that come into force from the

It really is decision time for professional trust service providers and many will already be ‘in the thick’ of supporting

My dad was a mechanic – a pretty good one from all accounts. That’s him in the photo. He’s always

In recent weeks, concerns have grown about the potential effect of a spreading coronavirus on the global economy and on

Maybe we will have a recession, maybe we won’t—but be wary of predictions on how markets will behave. It’s a

Our world in 2019 is full of acronyms. For a long while we have had SKI (Spending the Kids Inheritance)

Does your NZ family trust have UK tax obligations? If your family trust has a ‘UK tax connection’ the trust

Many New Zealanders don’t have a Will in place, and of those that do, we find fewer have established Enduring

Whilst we would like to ensure our families are looked after when we pass on, we want to help spark

How many times do investors think that they or their advisers know which funds or stocks to pick and when

We regularly get asked “Is it worth me having a Trust anymore?” As you would expect from a Lawyer, the