Getting A Pass Mark

Garrison Keillor is a US author who created a fictional town for a US radio show. The town was called Lake Wobegon, and was apparently situated in Minnesota, on the edge of the prairie. It was also described as “the little town that time forgot and the decades cannot improve”, and more famously a place “where all the women are strong, all the men are good-looking, and all the children are above average.”

The mathematically inclined will appreciate the humour in the line “all the children are above average”, as it is statistically impossible for this to occur. What was supposed to be an amusing turn of phrase actually described a cognitive bias called Illusory Superiority. It is a condition where a person overestimates their skill and abilities in relation to other people’s skills and abilities. The condition also has a few other names, such as the “above-average effect”, “superiority bias”, and the “Lake Wobegon effect”.

Studies have demonstrated this effect in various studies, such as a 2000 survey of Stanford MBA students, of whom 87% considered themselves above average. Similar results can also be found when surveying driving skills. Where this cognitive bias affects investors can be seen in share traders buying and selling shares between themselves, each believing they have made a good bargain.

A similar effect can be seen among active fund managers. The premise of active management is that, due to the skill of the manager, investors will receive above average returns. In some cases, this is accurate – there are fund managers who provide returns in excess of market returns. The converse also occurs – some fund managers provide below market returns.

Some people may consider this an investment opportunity – if you can identify the correct fund manager, you can receive above market returns. Admittedly there is a risk of choosing a poor fund manager, but you can rationalise this because all investments have some level of risk attached to it.

For investors, it is not enough to simply appreciate that there is a risk – you should know what level of risk you are exposing yourself to because not all risks are equal. Take the risk of capital loss (ie your investment is worth less than you put in) as an example. This risk is always present, even with “safer” investments like term deposits. That being said, it is safer to have a term deposit with a major New Zealand bank compared to a term deposit with a minor finance company. The reason some investors choose to place deposits with finance companies is that they provide a higher interest rate compared to the safer bank deposit. Simply put, the investor has judged that the higher return from the finance company is compensating the investor for accepting a higher level of risk.

You also need to assess the level of risk when looking at fund managers because not all risks are created equally. It is hard to assess the risk that your chosen active fund manager will have a below market return. Rating companies provide a lot of detail on fund managers, but they do not provide a guarantee of above market returns.

Instead of looking at individual fund managers, let’s look at the overall odds facing an active investor choosing a fund manager. Standard & Poors (S&P) reviewed the performance 860 Australian equity funds, 436 international equity funds and 116 Australian bond funds over a range of timeframes. Over longer time periods of 5, 10 and 15 years, they consistently observed underperformance in most categories.

Putting some numbers around this analysis, in the general Australian equity category, over the year to 31 December 2018, in excess of 86% of funds did not outperform the index. For the 10 and 15 year periods, over 83% of funds did not outperform the index. From this we can see that some funds did outperform the market, but they were massively outnumbered by the number of funds that failed to outperform the market. The odds were not in the investors’ favour.

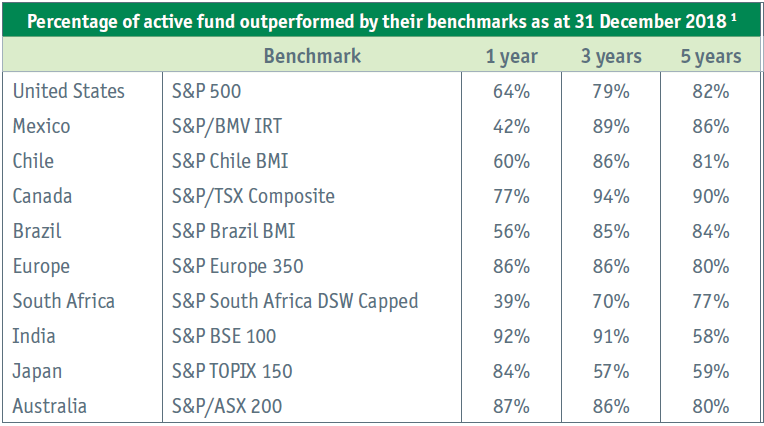

This is not an uncommon scenario. S&P also reported on the performance of active funds around the world. Below are the percentage of active fund managers who were outperformed by their benchmarks.

The conclusion is that most active fund managers are unable to beat their benchmarks. Some can manage it for a short period – as seen by the generally lower percentage in the 1 year column. Over longer time periods, over 80% of active fund managers cannot beat their benchmarks (with India and Japan being the main exceptions, and even then a majority of active fund managers are still beaten by their benchmarks).

If you want your investments to beat the market, choose carefully. The odds are not in your favour. The alternative is to focus on getting a market return. You may not be able to claim the best return, but beating 80% of the alternatives is a good starting point.

Technical, but necessary?

The problem with this sort of analysis is that it can seem a bit dry. What makes it relevant for investors, outside of bragging rights around the barbeque?

Most investors are saving for their retirement. The goal is not to be in retirement having won first prize in the stock picking competition. The goal is to ensure that you have enough money to fund the lifestyle you want in retirement.

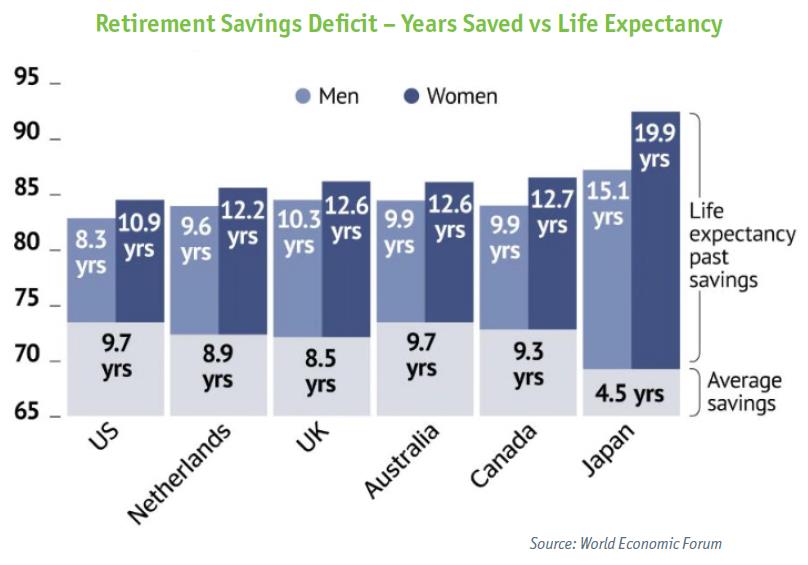

Investors will only get one chance at their retirement. The risk for investors is that they will not have enough income to last them in retirement. This is a common concern, and the World Economic Forum** has produced the graph below which illustrates the size of the problem of retirees outliving their retirement savings.

As a side note, you can see that Japanese retirees are expected to have the longest life expectancy past their savings. This partly reflects Japan’s longer life expectancy, but the primary driver is that the average investment is in defensive assets with low expected returns (such as cash), even for very young investors (eg 25 years old). As a result, their savings do not grow sufficiently to cover their retirement expenses. Choosing an inappropriate asset allocation can be as disadvantageous as choosing a poor active fund manager.

New Zealand is not included in this analysis, but the Financial Services Council reported*** in 2017 that “income from this accumulated wealth may run out for the majority of those aged 65+ within just 10 years after they stop work, leaving them with state pension income only for a decade or more”.

That would suggest New Zealand retirees are in a similar position to retirees worldwide.

The risk of outliving your retirement savings is real. It is complicated by uncertainty over the level of expenses you will face in retirement, and the level of income that will actually be generated to fund those expenses. Proper financial advice should consider both of these problems.

1 SPIVA Around the World, Standard & Poors

** Investing in (and for) Our Future, World Economic Forum White Paper, June 2019

*** Great Expectations, December 2017, Financial Services Council

Source: IOOF New Zealand – Portfolio Comment 30 June 2019