A question we’ve been asked quite a few times within the last year goes something like this,

“So my son is investing on Sharesies. What do you think of them…?”

It’s a great question and one we thought deserved an article of its own.

Sharesies, Hatch and other digital trading platforms easily accessible by smartphones have grown enormously popular in recent years. Sharesies claims to have 350,000 users which would be about 7% of the population of New Zealand. That’s a remarkable achievement.

There are a number of positive aspects to these digital trading platforms. Easy to access and requiring only a small amount of cash to begin investing, they appeal to younger investors, and we now see New Zealanders investing (and saving) at a younger age. The result will hopefully be an increase in financial literacy born out of experience.

However, it’s a more nuanced question as to whether or not these platforms are leading to successful investing outcomes. Successful compared to what? Compared to term deposits? Compared to the average return of the market? The answer depends on the basis of the comparison. Unfortunately, we don’t have data available from these New Zealand platforms so it’s hard to evaluate the average performance of their investors.

While online trading platforms have only recently gained popularity in New Zealand, they have been around internationally since the 1990s. In the United States, Ameritrade, E-trade, Scottrade and more recently Robinhood, are all examples of online trading platforms. Having access to this longer-term international data lets us assess performance by looking at the evidence.

The academic peer-reviewed evidence shows a fairly consistent pattern. Those who trade online, and especially those who trade frequently, typically do worse than the market return.

One of the first studies of online trading platforms was conducted in 2000 by Dr Brad Barber (University of California, Davis) and Dr Terrance Odean (University of California, Berkeley), titled “Online Investors: Do the Slow Die First? (1)

Easy to access and requiring only a small amount of cash to begin investing, they appeal to younger investors, and we now see New Zealanders investing (and saving) at a younger age.

Their general conclusion was that investors who switched to trading online traded “more actively, more speculatively, and less profitably than before – lagging the market by more than 3% annually.”

That raises the question; if investors are less successful, why do they do it? The authors say their findings can be explained by, “overconfidence, augmented by self-attribution bias, the illusion of knowledge, and the illusion of control.” In other words, investors do worse because they give themselves too much credit when they are just fortunate with their picks, and they have a strong self-belief whether or not they actually have stock picking ability. Lastly, they feel like they have more control over investing outcomes than they really do.

Sources: 66,465 households with accounts at a large discount broker during 1991 to 1996, Barber, Brad M. and Odean, Terrance, Trading is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors. Available at SSRN: https://ssrn.com/abstract=219228 or http://dx.doi.org/10.2139/ ssrn.219228

After the adoption of trading by smartphone, investors are also more likely to purchase risky and lottery-type assets and to chase hot investments on their non-smartphone trading platforms as well.

This result isn’t surprising. In 2002 the same authors published an article in the Journal of Finance called “Trading is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors. (2)

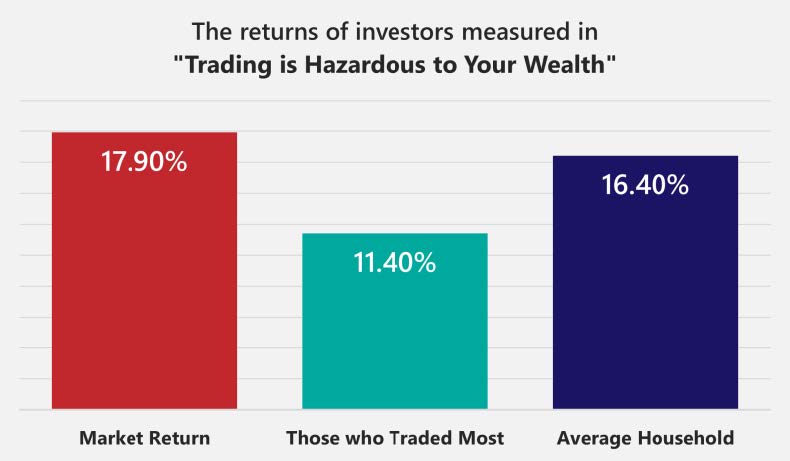

In this study they discovered that of 66,465 households that had an account with a discount share trading platform, the ones that traded shares most frequently underperformed the market by 6.5% per annum (i.e. an average high-trading return of 11.4% compared to a market return of 17.9%). The average household with a trading account underperformed by 1.5% (i.e. an average household return of 16.4% compared to a market return of 17.9%).

Perhaps more relevant is a recent European study on the impact of technology on individual investors. In February 2021, Drs Ankit Kalda, Benjamin Loos, Alessandro Previtero and Andreas Hackethal, published “Smart(Phone) Investing? A within Investor-Time Analysis of New Technologies and Trading Behavior.”3

The authors looked at the period from 2010 to 2017 and the results of two European banks that introduced online trading via mobile devices.

Below is a summary of a some of their key findings:

- Smartphone users were about 8 years younger and 13% more likely to be males compared to nonusers.

- Smartphones increased the purchasing of riskier and lottery-type assets and the chasing of past returns by 67%.

- Smartphone trades involved assets with higher volatility.

- Smartphones increased the probability by 71% of buying assets in the top decile of the past performance distribution.

- Smartphone investors chased performance evidenced by the fact that 68% of purchases involved assets that had earned above median returns in the recent past.

After the adoption of trading by smartphone, investors are also more likely to purchase risky and lottery-type assets and to chase hot investments on their non-smartphone trading platforms as well.

Perhaps this academic speak can be better understood in light of a recent headline grabbing story “GameStop stock price crashes as Robinhood app restricts trading. (4)

The idea that individual investors may be more inclined to buy a share after its price has gone up is behaviourally intuitive, but it’s not a particularly profitable strategy, at least according to most long-term measures.

Novice investors using the trading app/platform Robinhood bid up the value of a video game store called GameStop. The decision to invest in that business was not based on any careful evaluation of the business’s future prospects. Many investors piled in based on speculation alone. When it crashed some of those investors lost money.

This experience highlights a broader trend the authors of the Smart(Phone) Investing article bring to light. While smartphones offer convenience, that convenience sometimes comes with a cost of increased risk and reduced returns from lottery-like stocks which have historically produced worse than average subsequent returns.

The infographic above provides a snapshot of the three academic articles. These results are not particularly surprising. While in many ways Sharesies provides easier access to investing, we know from years of experience that investing isn’t easy. What feels intuitive is often misguided and can lead to poor long-term outcomes. The idea that individual investors may be more inclined to buy a share after its price has gone up is behaviourally intuitive, but it’s not a particularly profitable strategy, at least according to most long-term measures.

It’s no accident that advertisements for online trading platforms generally show the brands of some of the world’s most successful technology companies with good recent performance. But what young investors don’t realise is that those investments are also some of world’s most expensive companies based on earnings and prices. That doesn’t make them a bad investment. But a concentrated investment in those companies is far riskier than the ‘investing is easy’ advertising would lead you to believe.

In summary, if you have kids using online trading platforms in a casual way with small amounts invested, we believe this can result in many positive outcomes. It will increase their comfort with investing and likely lead to an increase in financial literacy. However, it may also lead to overconfidence, and the weight of evidence suggests you (and they) should expect outcomes lower than the market average.

When it comes to smart investing, the same principals always apply, regardless of age. If your kids are investing large amounts of assets they can’t afford to lose, they should probably seek a second opinion.

(1) Barber, Brad M. and Odean, Terrance, Online Investors: Do the Slow Die First? (December 1999). EFA 0335, Available at SSRN: https://ssrn.com/abstract=219242 or http://dx.doi.org/10.2139/ssrn.219242

(2) Barber, Brad M. and Odean, Terrance, Trading is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors. Available at SSRN: https://ssrn.com/abstract=219228 or http://dx.doi.org/10.2139/ssrn.219228

(3) Kalda, Ankit and Loos, Benjamin and Previtero, Alessandro and Hackethal, Andreas, Smart(Phone) Investing? A within Investor-Time Analysis of New Technologies and Trading Behavior (January 13, 2021). SAFE Working Paper No. 303, Available at SSRN: https://ssrn.com/abstract=3765652 or http://dx.doi.org/10.2139/ssrn.3765652

(4)https://www.abc.net.au/news/2021-01-29/gamestop-stock-price-crash-as-robinhood-restricts-buying-shares/13101670