Picking Winners

The media locks in on a particular ‘hot’ sector.

In the late 1990s, it was technology. In the mid-2000s it was mining. Writing about fashional sectors is one thing. Building sustainable investment strategies around them is another. Finance journalists tend to write lots of articles about particular industries or sectors because these stories fit into a current narrative. In the tech stock boom, it was the information revolution. In the mining boom, it was the rise of China.

Of course, the changes in the global economy brought about by innovations in digital technology and communication is a real story, as is the impact of China due to its rapid industrialisation and global integration of the past 15 years.

The big question for investors is what information about those trends can you act on that is not already reflected in share prices? Too often, people end up trying to jump on a train that has already left the station.

In the Australian share market, for instance, mining stocks boomed last decade amid voracious demand for coking coal and iron ore from steelmakers in China, the world’s largest producer and consumer of steel.1

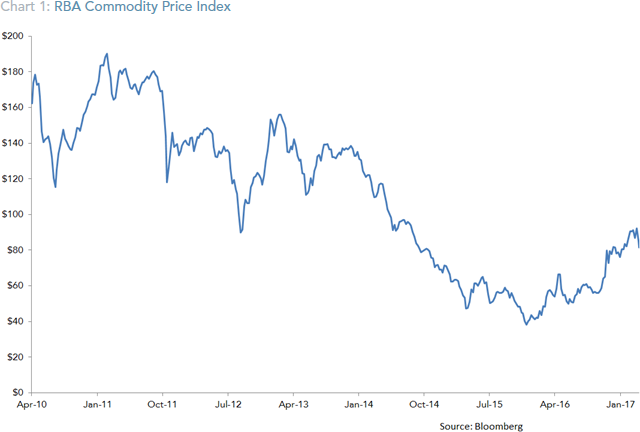

The performance of stocks like Fortescue Metals Group mirrored what was going on in commodity markets. From mid-2003 to mid-2011, the Reserve Bank of Australia’s index of commodity prices roughly quadrupled in value. (Chart 1)

By 2012, new iron ore supply was coming online just as China’s expansion started to slow and steelmakers’ demand moderated. Spot iron ore prices fell by nearly 80% from a record $US180 a tonne in 2011 to around $40 by late 2015. (Chart 2)

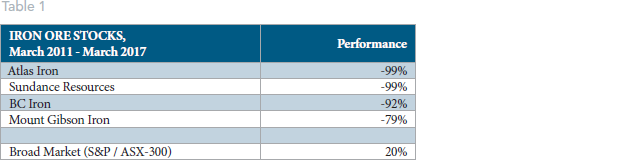

The market prices of mining stocks followed suit. On the Australian market over the four years from 2012-2015, many of the worst performing stocks were either iron ore miners or companies that serviced that market.

While iron prices recovered a little since then to near $80 as at March 2017, bringing mining stocks with them, many of these stocks still lagged the wider market’s performance over the past six years. (See Table 1)

This story is a powerful argument for the virtues of diversification. The more concentrated the portfolio, the more it is exposed to these idiosyncratic events beyond the control of an individual investor. Diversification involves spreading risk and diluting the influence of sector-specific themes. Just as materials stocks struggled from 2012-15, other sectors such as healthcare and telecoms and financials did well. Resources bounced back in 2016, while healthcare, telecoms and financials lagged.

The fact is that trying to forecast the best performing sector or industry from year to year is a mug’s game. Observing that commodity prices are rising again is not useful information for you as an investor because that’s already reflected in the market.

But diversification does not just apply to sectors. We can also manage it by using all the information about expected returns that is available to us. Academic research has identified certain dimensions that point to differences in expected returns. To meet this definition, they must be shown to be sensible, persistent across different periods, pervasive across markets and capable of being cost-effectively captured.

The four dimensions are the degree to which the portfolio is exposed to stocks versus bonds, to small companies versus large companies, to low relative price stocks versus high relative price and to high versus low profitability firms.

In the small cap end of the Australian market, we can manage company specific idiosyncratic risk by holding a well-diversified portfolio. Furthermore, we can improve expected returns by overweighting stocks with higher profitability.

Of course, this does not mean a portfolio will be completely immunised against idiosyncratic risk. But it is a way of diluting those influences and ensuring a balance between improving expected returns and achieving appropriate diversification.

So, we’ve learnt that chasing ‘hot’ sectors and industries is a good way of getting your fingers burnt. But through diversification, discipline and maintaining a level of flexibility, we can help ensure that a single sector doesn’t have a disproportionate influence on your investment outcome.

Jim Parker – Dimensional Vice President, Outside the Flags May 9, 2017