The Chinese Coronavirus and its impact on Global Share Markets

In recent weeks, concerns have grown about the potential effect of a spreading coronavirus on the global economy and on share markets around the world. This coronavirus, a form of pneumonia (now labelled Covid-19), is a new disease that originated in China and still remains largely based in China. The disease, however, has begun to spread to other countries, most notably South Korea, Japan and Iran and it does appear to have some potential to slow economic growth, certainly in China, but also in economies reliant on China, including Australia.

In recent days some investors have taken fright, so that in the case of the all-important US stock market, the broad market (S&P500 index) fell 4.6% from its record peak on 14 February over the 10 days to 24 February. From 1 January this year though, net market movements have been more subdued, including a 0.1% decline for the broad US market, while the UK, German, French, Chinese and Indian markets fell respectively by 5%, 2%, 3%, 1% and 2%. On the other hand, over the same period this year, the Australian market (ASX200) rose by 4% and the technology-focused Nasdaq index in the US rose 3%.

In other words, market movements since the start of 2020 have been limited, despite an increased awareness and fear of the potential spread of this new coronavirus in recent days. Thus recent share market declines should be kept in perspective, as global share markets have been enjoying a bull run since early in 2019 and in many cases had run very strongly before this recent market correction. This recent pull-back means that most major stock markets are now more attractively priced than previously and most share markets continue to appear better value than most other investment opportunities, such as bond markets or cash holdings.

It should be kept in mind that share markets are inherently volatile, with periods of price rises following periods of decline. The overall trend of share markets though tends to be positive, as long as the economic fundamentals underpinning these markets remain favourable. This is because when we invest in the share market we are actually investing in the broader economy through the companies that make up that economy. If company earnings are on an upward trend, then share market prices are likely to follow this trend.

At present, despite the emergence in recent weeks of this coronavirus in China, global economic fundamentals continue to look reasonably positive. Although the International Monetary Fund (IMF) recently marginally revised down its global growth forecasts for 2020 and 2021 (from 3.4% to 3.3% in 2020 and from 3.5% to 3.4% in 2021), forecast growth rates remain on a par with the long-term trend (around 3.3%), led by a strong US economy. The US economy has been growing at a real (inflation-adjusted) rate of over 2% per annum and has seen the unemployment rate decline to a 50-year low. Despite this solid performance, however, the US central bank (the ‘Fed’) has maintained a relatively ‘loose’ monetary policy, lowering interest rates over the past year and increasing liquidity in the financial system (‘quantitative easing’ or ‘QE’) in recent months.

Also positive is the outlook for corporate earnings this year, not only in the US, where earnings are forecast to grow by around 8% this year and 12% in 2021 (Yardeni Research, 25 February) but also in other jurisdictions such as Europe (7% and 8%). Even better is the outlook for key emerging markets, such as India, where earnings are forecast to grow by 23% this year and 16% next year and even China, where despite the coronavirus hindering growth, earnings are nevertheless forecast to grow by 11% this year and 14% in 2021. The outlook for our own corporate sector is also positive (earnings growth of 4% and 3%). Overall, this bodes well for share market valuations. In most economies, monetary policy remains highly expansionary, with official interest rates now below 0% in Europe and in Japan and with ‘quantitative easing’ continuing in both regions, as well as in the US since last September. This is also positive news for both continuing economic recovery and for share market performance over time.

In the Australian context, of course, it’s economy tends to do well when the rest of the world is growing strongly. Our own share market tends to follow directional trends from the major overseas markets, especially the US, but has the added attraction of a high dividend yield.

Conclusion

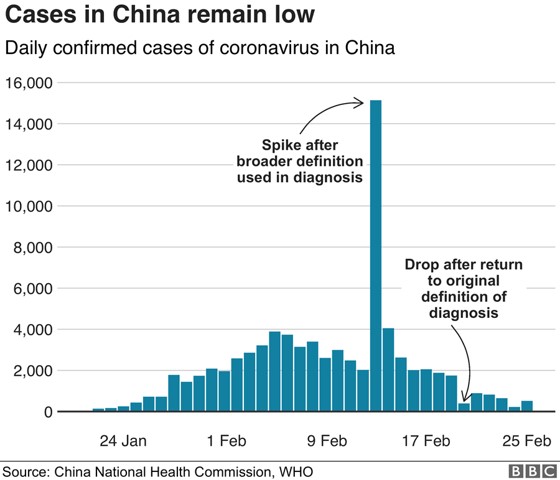

Share market volatility is likely to remain high as long as the coronavirus continues to affect higher numbers of people and as long as it continues to spread to other countries. However, as the above graph demonstrates, there seem to be indications of success in containing the spread of the virus in China, while in Australia the virus still remains almost non-existent. As far as global share markets are concerned, this recent correction has pushed markets back to fairer valuation levels and further upside appears likely in time, given continuing solid growth in the US and ongoing recovery in Europe and Japan. In the case of China, the economy is likely to slow markedly over the March quarter and, on some forecasts, could even record close to 0% growth for this period. However, assuming that the virus can be further contained and assuming that the total number of those infected with the virus begins to decline significantly, the Chinese economy could be expected to begin to recover sooner rather than later. In turn, this would be positive for further global recovery and for share market performance over the rest of this year.

Our advice to investors is to stay well diversified across asset sectors………investing in growth assets is for investors who have a longer-term investment horizon, which allows time for markets to readjust to periods of negative volatility and, in time, resume their upwards trend. Certainly, now is not a time to panic, to sell out in haste and to potentially realise capital losses in some cases. Now is a time to stay invested and ride through the current period of market correction and to await a resolution of the Covid-19 coronavirus epidemic, after which share markets could potentially rebound in time.

Source: Conrad Burge, Fiducian Group Ltd